This paper is a joint project of Radford and Cooley LLP. Together, we set out to understand why the prevalence of inducement grants is rising, the business case behind them, their effect on equity burn rates, and key compliance issues compensation committees and business leaders need to be aware of before taking action.

At the high-growth companies we work with, there is a marked increase in the use of new-hire "inducement grants." This lesser-used distribution vehicle allows companies to grant awards to new employees without depleting shareholder-approved equity plan pools. This exception, allowed by Nasdaq and NYSE listing rules, isn't new to compensation pros; however, more companies are finding new business cases for using this vehicle.

Inducement grants are primarily used for hiring top executives, often when there are insufficient shares in an equity plan's reserve to accommodate large grants. The exception may also be used in M&A situations as an incentive to attract and retain employees at a target entity. Today, we also see companies using the exception for new-hire awards granted to multiple employees hired to build out entire departments or teams. This is particularly common at life sciences companies as they transition to commercial operations and create entire marketing and sales departments, or at technology companies developing new products or expanding into new markets.

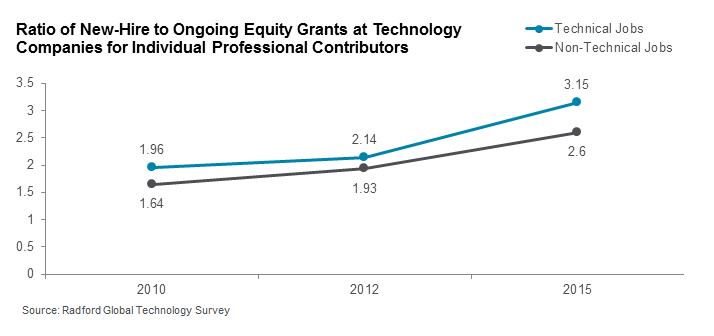

The highly competitive hiring environment in the technology and life sciences sectors is driving up the use of new-hire awards in general, and when a company's shareholder-approved equity pool is strained by such grants, there is a strong case to be made for inducement grants. Indeed, as evidenced by the chart below, the ratio of new-hire to ongoing equity awards at technology companies has increased in the past five years. (For more details on the rise of new-hire equity awards, see Radford's article As the Race for Top Talent Intensifies, US Tech Firms Ratchet Up New-Hire Equity Awards.)

Inducement grants became more common in 2003 after Nasdaq and the New York Stock Exchange (NYSE) began requiring shareholder approval for equity awards and equity plans but kept the inducement grant exception intact.1

As mentioned, inducement grants allow companies to circumvent the share limitations of their equity plans, thus allowing companies to fuel their growth without having to ask shareholders to approve additional shares more often than necessary. In the current governance environment, equity plans are receiving greater scrutiny from proxy advisory firms and institutional shareholders and, in some cases, higher levels of against votes. In addition, many companies are not able to request as many shares as they would like to add to their equity plans, due to the need for proxy advisory firm support. For example, in the first half of 2016, Institutional Shareholder Services (ISS) recommended against the equity plan proposals of around 34% of biopharma, software and hardware companies' and against 23% among the entire Russell 3000 companies. That represents a notable increase from the first half of 2015, when ISS recommended against the equity plan proposals of around 22% of biopharma, software and hardware companies' and against around 18% among the entire Russell 3000 companies.

For all of the benefits of the inducement grant exception, there are several factors to consider with this method of delivery. This paper will discuss the different types of inducement grants and the rules around their use, the impact of inducement grants on equity burn rates and dilution at technology and life sciences companies, and provide tips on how to know if inducement grants are the right tool for your company's situation.

1 Inducement awards are one of a handful of exceptions allowing for the grant of equity awards without shareholder approval, including exceptions for shares issued under tax-qualified non-discriminatory employee benefit plans and plans or arrangement relating to a merger or acquisition.

Inducement Grant Types and Prevalence

Inducement grants can be in the form of all types of equity awards, including stock options, stock appreciation rights, restricted stock units, restricted stock and performance-vesting stock awards. However, as discussed below, inducement grants may not qualify as "incentive" stock options. In addition, inducement grants may not qualify as "performance-based compensation" that is exempt from the $1 million annual tax deduction limitation for certain covered individuals.

There are three primary ways to structure inducement grants:

| Inducement Pool |

Inducement Plan |

Stand-Alone Inducement Grants |

|

The company amends their current shareholder-approved equity plan to provide for a special designated pool of shares to be used specifically for inducement grants.

The awards granted under the inducement pool are subject to all other terms of the plan.

A company that wants to award inducement grants to more than one recipient, often over a period of time, but retain all of the same provisions of their current equity plan (as if the inducement award was granted under that plan) may prefer this approach.

This method also streamlines administrative costs and time. For example, it requires less drafting of new documents (the current award agreement usually requires only minimal changes) and the proxy disclosure is simpler. However, it is very important to separately administer and track awards under the inducement pool from those granted under the shareholder-approved equity plan pool.

|

Under this approach, a company adopts a new equity plan, separate from their current shareholder-approved equity plan that is used entirely for inducement awards. The plan may or may not be similar to the company's shareholder-approved equity plan.

A company might choose this method if it is awarding inducement grants to more than one individual but wants the flexibility of having a stand-alone inducement plan with its own provisions. In addition, it may be easier, from an administrative and employee communications standpoint, to maintain all inducement awards in a separate plan.

|

The company can approve an inducement award that is not under any equity plan.

A company that intends to grant an inducement award to one individual or in very unique circumstances may choose this approach. This approach is also taken by companies that do not want to amend their shareholder-approved equity plan or are seeking to minimize the attention investors or other employees may pay to the grant.

This approach requires the individual award to contain all the terms necessary to govern the terms of the award, which may require more drafting but also provides an opportunity to alter the terms from those of the shareholder-approved plan, if necessary.

|

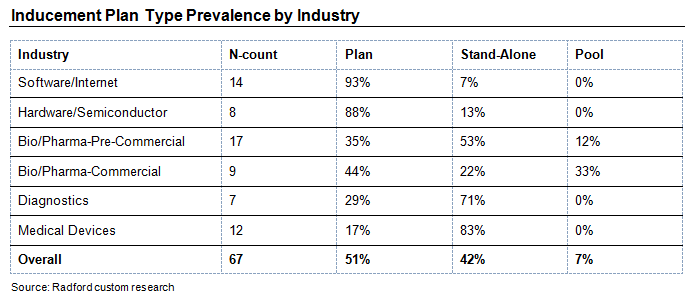

In our research of technology and life sciences companies that used inducement awards from 2012 to 2015, we can see that granting inducement awards under a new inducement plan separate from the company's existing shareholder-approved equity plan is popular among technology companies and more mixed among life sciences industries. For the life sciences sector, it is likely that companies opting for a separate plan are reacting to preparing for or receiving FDA approval for drugs and devices and building out a sales force or rounding out the senior leadership team; in these cases, designating the purpose for inducement grants becomes important in explaining the additional dilution.

Requirements for Inducement Grants

In order to qualify for the inducement grant exception, the following requirements need to be met under Nasdaq and NYSE listing rules 2:

- New Employees Only: The inducement grant exception is only available for someone joining the company as a new employee, or someone who was previously an employee or director but is rejoining the company following a bona fide period of non-employment. 3 The exception is not available to induce an individual to join the company as a non-employee director, consultant, advisor or independent contractor.

- Independent Director Approval of Awards: Any inducement award must be approved by the company's independent compensation committee or by a majority of the company's independent directors, as determined under the Nasdaq and NYSE standards of independence.

- Material Inducement: The award must be a material inducement to the individual accepting the job. In other words, the company communicates the award terms prior to job acceptance, and the grant is discussed in connection with the hiring process. To comply, companies ensure that offer letters or employment agreements contain the specific terms of the inducement award, including the actual number of shares to be granted, and often explicitly stating that the proposed award is intended to be a material inducement to the individual's employment by the company prior to the candidate accepting a job offer. In M&A transactions, the offer letter with this information should be delivered prior to closing the deal.

- Inducement Awards Not Eligible for Incentive Stock Option Status: Since the shares underlying an inducement award are not approved by shareholders, inducement awards in the form of stock options will not qualify as incentive stock options that provide the opportunity for certain tax benefits. However, the implications of this are often minor or inapplicable given the tendency for many employees to not hold incentive stock options for the requisite tax holding periods, the tax limitations on the amount of options that can be granted as incentive stock options and the general tendency for mature public companies to not grant incentive stock options. Further, we are seeing a greater use of inducement grants using restricted stock or restricted stock units (RSUs). According to our research, 13 years ago, only 3% of technology companies had RSU-centric equity strategies (i.e., more than 50% of their equity awards were in the form of restricted stock). By 2008, 42% of technology companies were RSU-centric, and by 2013, nearly three-quarters had RSU-centric equity strategies. Virtually all life sciences companies were option-centric in 2003, and while the use of RSUs is growing, still more than three-quarters of them remained so through 2013— a function of the broader industry equity strategy.

- Shareholder Approval for Modifications: While we stated above that shareholder approval is not required in order to grant the original inducement award, shareholder approval may be required to materially amend an equity award granted under the inducement exception and this can be a trap for the unwary. Under Nasdaq rules, shareholder approval is required to "materially" amend an award if it results in a material increase in the benefits to the holder of the award.4 For example, an amendment to an option award granted under the inducement exception to reduce the exercise price of the option might require shareholder approval, even though the grant of the award did not require shareholder approval.

2 The relevant rules are Nasdaq Listing Rule 5635(c)(4) and NYSE Listed Company Manual Rule 303A.08.

3 A "bona fide period of non-employment" is determined on a case-by-case basis. While time period is a factor, other considerations include whether there was a relationship between the former employee and the company during the time of non-employment; whether the former employee received payments from the company during the period of non-employment; the reasons for ending the employment relationship; whether the former employee was employed elsewhere after leaving the company; and whether there was an agreement or understanding that the former employee would return to the company.

4 This may be contrasted with a material amendment to an inducement plan or inducement pool under which inducement awards are granted (e.g., to increase the reserve for inducement awards, or add a new type of inducement stock award that may be granted), which generally does not by itself require shareholder approval.

Disclosure, Registration and Listing Requirements

In addition to the above requirements, there are additional listing exchange and SEC disclosure requirements that follow the award, including the following:

- Press Release Following Grants: In order to qualify for the inducement grant exception, the company must issue a press release disclosing the material terms of the award "promptly" (generally within four business days) following the grant of an inducement award. The press release may aggregate multiple awards made over two weeks without including individual employee names, unless they are Section 16 executive officers. If the grants take place over a period of more than two weeks, the grants may not be aggregated and must be separately announced. An 8-K filing is not sufficient without an accompanying press release. The press release may also cover unrelated topics to the inducement award. Identifying the employee recipient of the award is required under certain circumstances, including if the award was to Section 16 executive officer.

- Listing Requirements: Both Nasdaq and the NYSE have requirements regarding filings requesting the listing of additional shares. These requirements include filings prior to the grant of the awards as well as filings or notifications upon grant of inducement awards. It is important for a company to carefully monitor these various requirements and the time frames for compliance.

- Securities Registration: The shares reserved for inducement grants must be registered. This is typically accomplished on a registration statement on a Form S-8. Under the rules for registration on a Form S-8, a prospectus document describing the material terms of the plan and awards, as applicable, and information about the company must be prepared and provided to the recipients of inducement grants.

- Proxy/10-K Disclosure: The disclosure of inducement awards must be included in a company's 10-K or proxy statement under the Equity Compensation Plan Information table. The company must disclose the number of shares subject to outstanding inducement awards; the weighted-average exercise price of outstanding inducement awards; and the number of shares remaining available for issuance under the Plan. An additional narrative disclosure must be provided with the table explaining the material terms of the inducement awards and an inducement plan as it was not approved by stockholders. If inducement awards were given to a Section 16 officer who is a Named Executive Officer, the material terms of those grants must also be disclosed in the Compensation Discussion & Analysis section of the proxy statement.

Impact of Inducement Grants on Burn Rate

Equity awards made under the inducement grant exception have pros and cons. On the one hand, they are a way of hiring top talent or making large staffing moves to fuel growth without having to count against your equity plan share reserve or fit within individual award limitations of such plan, thus avoiding the need for shareholder approval. On the other hand, inducement awards require close monitoring to ensure burn rates and equity overhang don't get out of control and raise red flags among your investor base.

In order to take a closer look at the longer-term impact of inducement grants, we pulled in our research on inducement grants at a representative sample of technology and life sciences companies between 2012 and 2015. We found the size of shares as a percentage of total common shares outstanding awarded under inducement grants were larger among companies that went public within two years of the inducement grant compared to companies that have been public for over 10 years. Inducement programs at newly public companies authorized shares equating to 2.1% of the company's outstanding shares, on average, whereas more mature companies tended to approve smaller inducement programs, averaging 0.9% of the company's outstanding shares. This data is further evidence that technology and biopharmaceutical companies are using inducement grants as a way to fuel growth after they go public and enter a period of more rapid expansion.

The majority of IPO equity plans include evergreen features, which allow for the flexibility to replenish the share reserve each year without needing shareholder approval. This data suggests that IPO companies, even with these evergreen provisions, may not have sufficient shares reserved for grants over the two to five years after going public. IPO companies should think carefully about the appropriate size of the shares reserved for future grants under their shareholder-approved plans, taking into consideration potential growth over the next several years and the burden of obtaining shareholder approval shortly after going public.

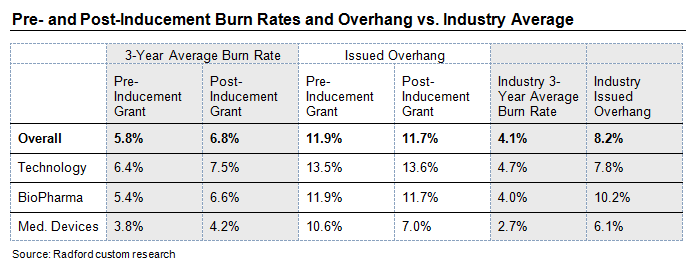

Among the nearly 70 technology and life science cases we analyzed between 2012 and 2015, we also saw the three-year average burn rate for companies in the years following an inducement grant increased 1.1 percentage points. At the 75th percentile, the increase was an impressive 3 percentage points. It's hard to fully remove other factors that could influence the connection between inducement grants and rising burn rates, such as the fact that growing companies are more likely to burn shares anyways and, therefore, predisposed to using inducement grants. However, the data clearly provides a reason to be careful in monitoring burn rates if your company is considering awarding equity under an inducement exception.

Companies that used inducement grants were also more likely to have higher burn rates and overhang levels before the inducement grant. Inducement authorizations further exaggerated these figures compared to the industry average. Overall three-year average burn rates prior to the inducement exception were 1.4 percentage points higher at the median. After the inducement, burn rates were 2.4 percentage points higher. The chart below illustrates median burn rates compared with companies that used inducement grants, both before and after the grants were awarded.

The inducement grant exception was intended to deal with key executive hires or rapid growth in a company, but left unchecked, the inducement grant exception could lead to extremely high burn rates and potentially high overhang over an extended period of time. This could be troublesome with institutional shareholders and their advisors. The concern is pronounced even further for those companies without an evergreen provision who will be requesting shares in the future. In this case the use of the inducement grant exception is just borrowing from the future, as inducement grants will be counted in proxy advisory firms' assessment of share usage and value transfer.

Proxy Advisor and Investor Perspective

Leading proxy advisory firms in the United States, ISS and Glass Lewis (GL), as well as many institutional investors, will include inducement grant overhang and usage in their applicable dilution and burn rate evaluations. Therefore, while use of inducement grants can help extend the life of a company's share plan, it can negatively impact a company's dilution and burn rate profiles relative to proxy advisory firm and institutional investor standards when it comes time to seek a new or amended share request.

Depending on the magnitude and duration of use, inducement grants may negatively impact perceived plan "cost" (as defined by shareholder value transfer or SVT) and burn rate requirements that must be satisfied in order to obtain a positive vote recommendation from ISS and GL on any future equity plan proposal submitted to shareholders for approval. It is important to note that grants made under an inducement exception aren’t "free"— they are in essence an advance on a future share request.

Inducement awards that have been granted are included in the three-year average burn rate calculation that ISS performs when analyzing a company's compensation practices. The burn rate policy calculation, in turn, can affect ISS's recommendation for an equity plan proposal. If a company's three-year average burn rate substantially exceeds industry-specific benchmarks it may be impossible for a company to score enough points under ISS's Equity Plan Scorecard methodology to obtain a positive vote recommendation for a share request.

Given that inducement grants can impact calculations in this manner, it is important to monitor a company's dilution and run rate profile relative to industry peers to ensure the company's inducement grant practices are not resulting in burn rates and overhang that are outside of peer group norms.

Looking Ahead

Companies can make a valid business case for using inducement grants, especially during a period of high growth and/or competition for top talent among a tight labor pool. Both of these conditions exist today for many technology and life sciences companies. For key new hires and for shorter term, well-defined critical hiring needs, inducement grants can be a very helpful tool. However, management should understand the various requirements for properly granting and effectively administering these awards, monitor overhang and burn rates, and boards should ultimately hold executives accountable for the use of the plan and projections of how the plan will be used.

We also caution companies against using inducement grants as a substitute for any meaningful changes to their current equity strategy. While inducement grants don't require shareholder approval and can be easier to adopt, if a company wants to permanently adjust the size of their new-hire awards, for example, the more sustainable approach is to make amendments to the equity share plan.

One of the biggest concerns for employers in using inducement grants is that it can become hard to manage burn rates of equity. While the grants themselves may not get flagged by proxy advisory firms, if burn rates get out of control it will raise governance concerns. Board members should hold management responsible for justifying the use of the inducement grant, monitoring burn rate and overhang, and most importantly, developing an equity strategy that is sustainable in the long run.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles