Demand for digital jobs is high, and e-commerce companies are paying a premium for key roles. Having the latest compensation data will help design compelling rewards policy for hot jobs.

The internet and e-commerce industry is seeing double-digit growth as consumers click and spend more online. To enable this growth, online retailers and other internet companies need to hire and retain people that have key technical skills such as software engineers. These types of roles are in high demand as companies across industries hire talent to compete in the digital age.

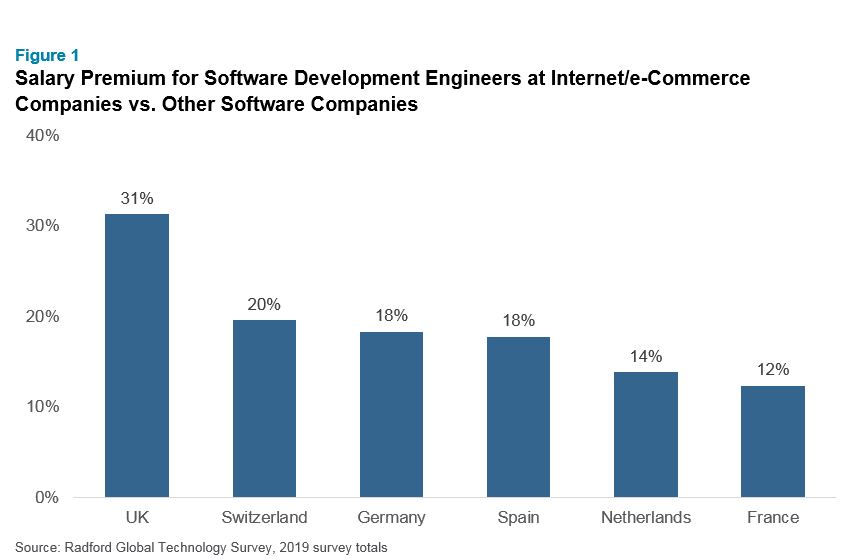

To evaluate how the demand for technical talent is impacting the market, we examined compensation levels for software engineers at internet and e-commerce companies compared to software companies, which were traditionally the primary employers for software engineers.

For our analysis, we turned to the Radford Global Technology Survey and analyzed median base salaries across select European countries for software engineers at Radford survey job levels 2, 3, 4 and 5, which is the equivalent of two to 12 years of experience in the field. We compared median base salaries across the four job levels between two peer groups: internet and e-commerce vs. other software companies (gaming, entertainment, fintech and software services/products).

We found that, on average, internet and e-commerce companies pay 10% to 30% more than other software companies for software engineers at aggregated job levels. Let’s dig a little deeper into our findings and what they mean for companies looking to hire in-demand technical talent.

Rewards Premium at e-Commerce Companies

The results of our analysis were consistent across all selected countries and paint a clear picture of the pay premium that internet and e-commerce companies are offering (see Figure 1). Whether a company is looking to find software engineers to develop a brand-new application or trying to retain UX designers, they are competing for a limited supply of digital skills in the market. And competition comes from all segments — a global social media giant, a multi-billion-dollar local e-commerce platform, an emerging fintech firm, an established enterprise software developer or a start-up with huge valuation multiples.

The highest average premium is in the U.K. at 31%, which is unsurprising given the intensity of competition and the concentration of major global technology companies and new startups in London.

While increased demand for software engineers is driving up all rewards components, we observe significant premiums for base salary and equity grants.

Other key findings from our analysis include:

- Experience Premium – We observed higher pay premiums for more experienced job levels, reflecting the difficulty of finding talent at these higher levels and the importance to retain these individuals as they are key to the success of the organization.

- Equity Premium – The gap in pay between our two peer groups is wider when we look at total direct compensation, suggesting that equity plays an important factor in driving the pay premium for software engineers at internet and e-commerce companies.

- Brand Premium – Large, global technology firms offer higher pay packages compared to smaller and mid-sized local organisations in European markets.

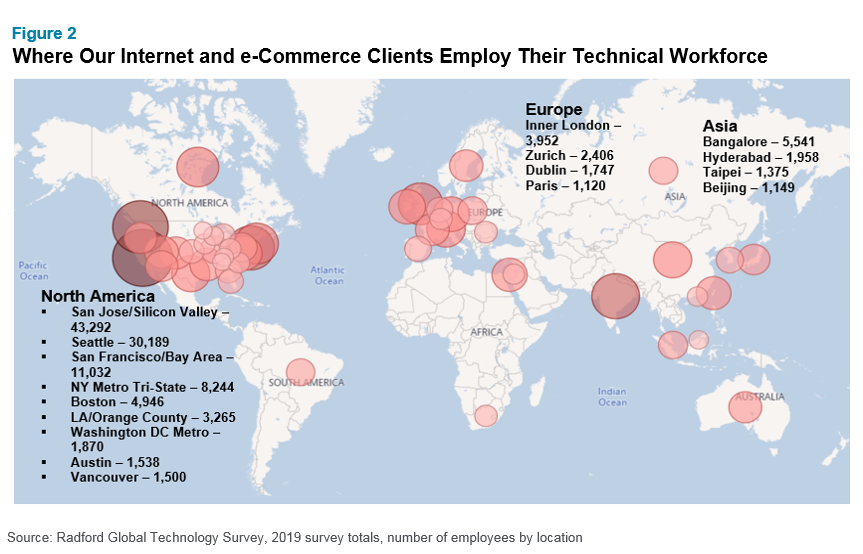

- Location Premium – Irrespective of the industry or size of company, certain technology hubs attract higher salaries due to the concentration of competition at these locations and a higher cost of living. For example, we recently looked at the U.K. market and found that inner London area salaries are, on average, 15% ahead of the overall U.K. market. Figure 2 shows the concentration of employees at e-commerce companies within the Radford Global Technology Survey. Within Europe, there is a much higher number of technical employees at e-commerce companies in Inner London followed by Zurich, Dublin and Paris.

Using Rewards Data to Inform Your Hiring Strategy

When benchmarking rewards data, it’s also important to take pulse of broader workforce trends, including mobility rates for key jobs. This will help determine the competitiveness of the market for certain roles, helping inform your broader rewards strategy.

The workforce trends data in the Radford Global Technology Survey shows the median turnover rate for product development and IT jobs at large internet and e-commerce companies across the globe (defined as having 900 or more employees) is fairly high at 21%. Meanwhile, the new-hire rate for the same group of companies is an impressive 31%. This means that, on average, e-commerce companies need to replace 21% of their workforce and then add an additional 31% each year. That’s a big task for human resources and compensation managers. Having access to compensation data that can target specific industries, jobs and geographic regions is critical to developing a compelling rewards strategy that will help retain current employees and attract new talent.

For more information about how e-commerce companies can develop a compelling rewards strategy to compete in the digital age, please see our article Developing a Winning People Strategy for New Types of Technology Jobs at Retail Companies.

Getting Started with Your Data Needs

The Radford Global Technology Survey is trusted by leading organisations from the technology and adjacent sectors. Our European database has more than 1,000 participants and is growing. The internet and e-commerce sector is a major participating group with more than 100 organisations. Our survey methodology captures over 20 specific e-commerce jobs (e.g., online marketing, online merchandising, social media, analytics, UX, etc.) in addition to the traditional retail job family (e.g., retail store operations, retail store staff and management, store representatives, cashier, merchandiser, buyer, etc.).

To learn more about participating in a survey or to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com.

Related Articles