Our new survey of severance and CIC practices at US technology companies reveals an increase in companies with polices, but there is still wide variation in how plans are designed.

Severance and change-in-control agreements can be an uncomfortable topic for companies to discuss with their employees, but it’s an area of heightened interest due, in part, to fervent M&A activity in the technology sector. As such, it’s an important housekeeping item for HR professionals to stay on top of.

In 2017, Radford surveyed 179 US-based technology companies on their practices for severance, change-in-control programs and equity treatment upon retirement. Unlike severance policies for the C-suite, which are required to be disclosed in the company proxy, practices below the C-suite are much less known. Our 2017 survey follows up on similar surveys we conducted in 2014 and 2011.

Below we highlight six important discoveries from the Radford 2017 US Severance & Change-in-Control Practices Survey at technology companies.

Trend #1: Most companies now have a not-for-cause severance policy for employees.

Seventy-five percent of participating companies report having an involuntary termination severance policy for employees. That figure is up slightly from 71% in 2014.

Trend #2: Companies are split on how they calculate the number of weeks of not-for-cause severance that is paid.

Companies are split on using job level, job tenure or both in determining the number of weeks of severance.

Figure 1

How Companies Calculate Weeks of Not-for-Cause Severance

| Severance Plan Structure |

Prevalence |

| Minimum rate of severance determined by level with additional pay based on tenure |

39% |

| Rate of severance is tied to the number of years of service |

36% |

| Rate of severance is tied to the level of the job |

10% |

| No severance plan |

15% |

Source: Radford 2017 Severance & Change-in-Control Practices at US technology companies

Our survey also goes a step further and looks at whether companies use a different method of calculating severance by job level. For example, senior executives are more likely than directors to have their severance calculated by level compared to number of years of service.

Trend #3: Companies that calculate not-for-cause severance based only on job level provide much richer severance benefits for VPs.

There is a dramatic drop off in the baseline average number of weeks of severance that companies provide for their vice presidents compared to directors, who are the next level down. The baseline number of weeks of severance levels off for managers, senior individual contributors, individual contributors and support.

On the other hand, companies that use both job level and tenure to calculate weeks of severance have some variation based on job level but very little variation for tenure. For example, vice presidents will receive nearly twice as many weeks of severance compared to directors based on their job level, while additional weeks of severance for tenure are calculated virtually the same way regardless of job level.

Trend #4: A majority of companies have a maximum cap on the number of weeks of severance provided.

Sixty-one percent of companies have a cap for the number of weeks of severance offered. That compares to 57% who reported a cap in 2014. The maximum allowed is typically higher for vice presidents than other job levels.

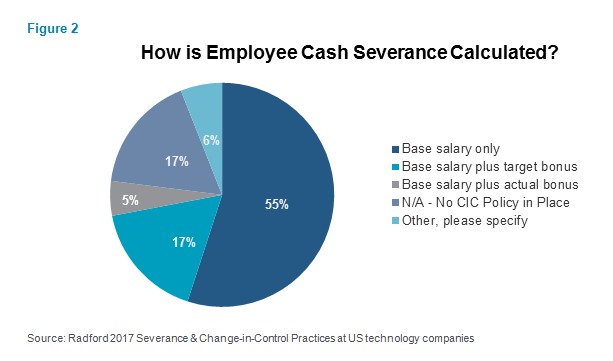

Trend #5: Most companies calculate cash severance for a change-in-control through base salary.

A little more than half of respondents (55%) say their cash severance for a change-in-control is calculated using base salary only. However, a sizeable minority (34%) also use either target or actual bonus as shown in Figure 2.

Trend #6: Single trigger vesting for a change-in-control is becoming a rare practice but still lingers.

Despite concerns from proxy advisory firms about single trigger equity vesting for named executive officers, some companies still use single trigger for their broad-based employees. The practice is more common at the vice president level. While single trigger vesting only requires a change-in-control event, double trigger vesting requires both a change-in-control and the termination of the employee. Eighteen percent of respondents reported single trigger vesting for their vice presidents— which is virtually unchanged from our 2014 survey.

*****

To learn more about and purchase results for the Radford US Severance and Change-in-Control Practices survey, please click here.

Related Articles