With only a few exceptions, the popularity of retention bonuses at life sciences companies continues to rise around the globe. We explore the latest data and trends below.

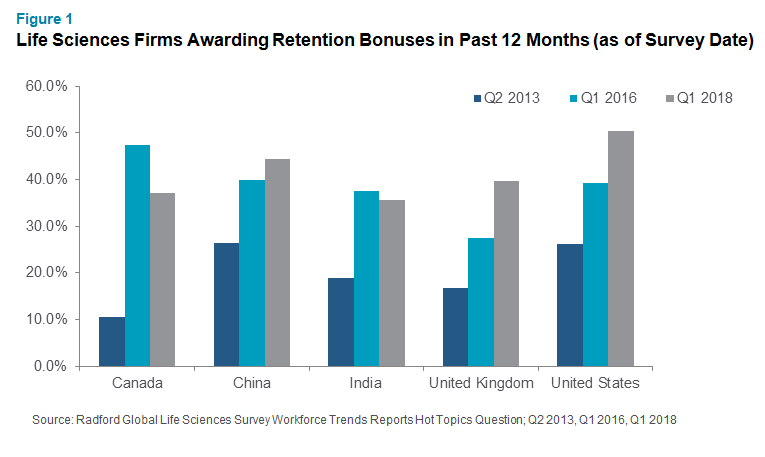

Periodically, we use our quarterly “hot topics” survey to check-in with clients on their use of retention bonuses. Between our first retention bonus survey in Q2 2013 and our second survey in Q1 2016, the prevalence of life sciences companies in key economies reporting the use of retention bonuses jumped dramatically. And while our Q1 2018 study did not reveal another round of 20- and 30-percentage point increases, it shows that our 2016 survey results were no fluke. Life sciences companies are increasingly reliant on retention bonuses.

While Canada and, to a lesser degree India, saw the use of retention bonuses taper off, prevalence rates went up in the United Kingdom (UK), the United States (US) and China. Retention bonuses are far and away most common in the US.

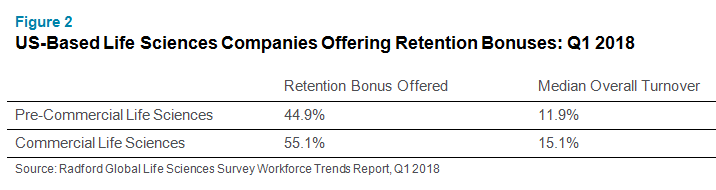

When we drill deeper into the data we find that US-based commercial firms relied more heavily on retention bonuses compared to pre-commercial firms. That could be a stopgap measure to curb high employee turnover in this market. Median overall employee turnover among commercial life sciences companies was 15.1% in Q1 2018 vs. 11.9% among pre-commercial companies.

In a robust job market where new-hire grants are on the rise, employees with critical job skills should have no problem switching jobs if they are feeling dissatisfied in their current role. This may have some companies scrambling to provide attractive cash alternatives that keep high-performing and high-potential talent engaged.

The market dynamics have changed quite a bit since we last surveyed life sciences clients on their retention bonus practices. Our last retention bonus survey in Q1 2016 came at a time when the stock market was beginning to show high volatility. Life sciences sector stocks plummeted 29.8% in the 12-months ending in May 2016, while the overall Russell 3000 dropped by only 4.5% during the same timeframe. As a result, employee equity holdings during this period decreased in value by a meaningful amount. This made employees feel less secure in their current roles, and simultaneously easier to poach with new-hire grants. This time around, our survey reflects the dynamics of both a hot job market and stock market. Under both conditions, retention bonuses are being used as a strategy for keeping key workers motivated and prevent them from leaving for competitors that are willing to offer make-whole grants.

Next Steps

When considering whether retention bonuses are the right strategy for your company, you should weigh the merits of bonuses against other options, such as increasing long-term equity awards, increasing base salary to ensure competitiveness and strengthening talent programs (e.g., improving working conditions that differentiate your firm, communicating a clear path for future professional development and job growth, etc.).

Retention bonuses can also be tricky because, by design, they are temporary. Even with a one-year clawback provision, the impact of a retention bonus is shorter term, so being mindful of ways to engage employees requires vigilance. The competitive hiring landscape among life sciences companies means retention will continue to be a concern for companies, which must be addressed with a longer-term strategy. Retention bonuses are absolutely necessary in some circumstances, such as uncertainty surrounding a merger or acquisition, but they should be limited to special circumstances and not part of large scale and sustainable retention strategy.

For more information on retention bonus design and values, please consult our Radford Global Life Sciences Survey Q1 2018 Workforce Trends Report.

To learn more about participating in a Radford survey, please contact our team. Or to speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles