In today’s competitive job market, more companies are looking at ways to turn their equity vesting schedules into a strategic advantage. We explain the pros and cons of taking action.

How would you like to give your company a competitive advantage in the race for top talent and potentially reduce your burn rate at the same time? This may sound like a far-fetched plan, but in some circumstances it is possible by reexamining how your company’s equity vesting schedules work.

Here’s the basic premise: for some companies, switching to shorter overall vesting periods for new-hire and ongoing equity grants might allow them to reduce overall grant sizes while still allowing employees to realize similar or larger annual vesting values. Additionally, making a move of this nature could also support higher participation rates and larger total equity grant values depending on the type of changes made.

Let’s consider the following scenarios to see how vesting schedules can impact award values:

| Example 1 |

Example 2 |

| Rather than granting a new-hire award worth $100,000 with a four-year vesting period that delivers a face value of $25,000 annually, consider granting a new-hire award worth $75,000 with a three-year vesting period that also delivers a face value of $25,000 annually. |

Rather than granting a new-hire award worth $100,000 with a four-year vesting period that delivers a face value of $25,000 annually, consider granting a new-hire award worth $100,000 with a three-year vesting period that delivers a face value of $33,000 annually. |

In the first example, both grants offer the same annualized face value ($25,000 per year), but the first option requires a larger overall award value and expense ($100,000 vs $75,000). In the second example, both grants offer the same overall award value, but the latter option allows the company to deliver more face value per year ($33,000 vs $25,000). In both examples, shorter vesting periods produce advantages.

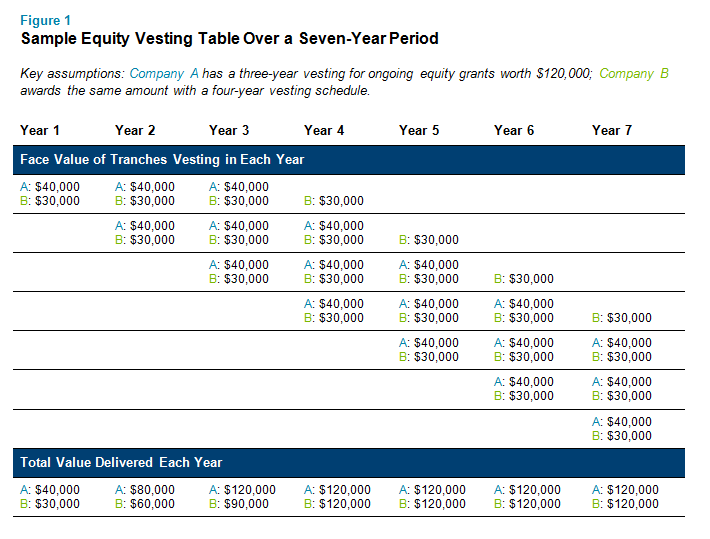

Another way to look at such scenarios is to model out both new-hire and ongoing equity grants over a longer period of time. Figure 1 below illustrates how companies with shorter equity vesting schedules (in this example, three years vs. four years), can deliver more value to employees in the short-term while still ending up paying no more per year than companies with longer vesting periods in the long run.

Evaluating the Pros and Cons of Shorter vs. Longer Vesting

The primary driver behind longer vesting periods is the desire to “lock in” employees for longer periods of time. However, in a highly competitive job market like this, retention is a challenging task. More organizations are luring away talent from their current employers by offering “make-whole grants.” As a result, the notion that an employee will stay at their place of employment largely because of unvested shares doesn’t hold as much weight as it once did— at least not at this particular moment in time. If a new employer offers to replace your existing shares with new shares that deliver value faster, you’ll likely be willing to consider a move. In other words, the name of the game right now is not about how much value you deliver, but how quickly you’re delivering it.

However, the question of adjusting your equity vesting schedules is complicated and every company should assess what makes sense for them. Your company’s rate of stock price appreciation is a critical factor the simplified examples above don’t address. For example, if your stock prices rises 10% each year and your company reduces the number of shares it grants each year to deliver a consistent value to employees, a four-year vesting period could end up being more valuable for employees compared to three-year vesting.

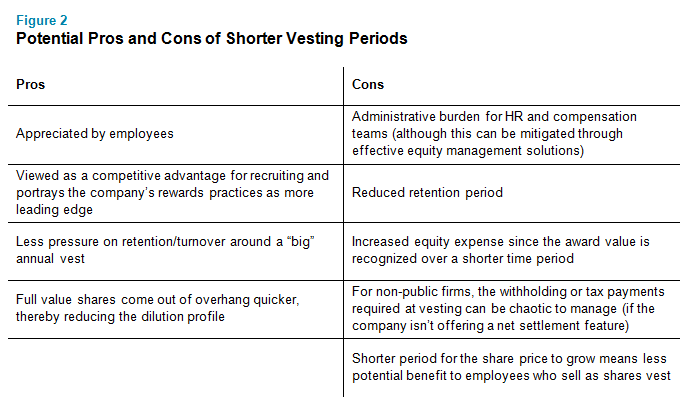

For this reason, while we’ve noticed a notable uptick in the number of companies actively contemplating moves to a three-year overall vesting period, or even quarterly vesting patterns, the majority practice remains a four-year overall vesting period for stock options and RSUs in the technology market. Meanwhile, vesting frequency is split between three and four year periods for RSUs at life sciences companies. Figure 2 below outlines additional pros and cons to consider before taking any action.

Determining the Right Vesting Schedule for You

Deciding on the right equity vesting schedule for your organization should involve careful thought. Companies are rightfully hesitant to make a change that could be perceived as risking employee loyalty in markets where employee turnover is high. Here are some things to keep in mind as you consider whether to make a change to your vesting frequency or overall periods:

- Vesting serves as a retention tool. Are you possibly at risk of losing key talent sooner if their equity vests more quickly? What other retention tools do you have that can be used to offset this risk? In reality however, the retention value of any equity may be limited in an environment in which new hire grants are often in excess of two to three times an annual grant for critical positions.

- What is the dominant practice among your peers? Are your competitors vesting their grants in three years and might your new employees expect you to do the same?

- How will switching vesting periods impact your total share usage and available share pool? Will you need to grant shares more often than you otherwise would, if the whole grant vests more quickly?

- Consider how a change in vesting periods can translate to a change in annual award size or impact the competitiveness of your overall long-term incentive award positioning. While theoretically possible to reduce the size of the grants, most of our clients make no reduction in annual grant levels. Instead, the shift from four- to three-year vesting provides a three year increase in the value delivered to recipients (assuming the stock price remains flat). After three years, the value realized each year by employees normalizes.

- How will a change in vesting impact accounting expenses? Just as three-year vesting will deliver value to employees more quickly, it will also accelerate your accounting expenses.

Next Steps

Any change in equity vesting periods should be contemplated as part of an overall compensation philosophy review. Vesting periods shouldn’t be looked at in a vacuum. As we noted above, there are a number of repercussions— both potentially positive and negative— that could result from changing vesting schedules.

When considering a change to your vesting schedule, also consider whether the same schedule should be used for new-hire and ongoing awards, and whether options and RSUs should follow the same schedule (assuming both are offered). We typically recommend companies keep a consistent vesting schedule for all types of equity incentives, since it makes the administration and communication of the awards much easier.

A key ingredient to making any change in vesting schedules successful is a well-executed employee communication plan. Any changes to ongoing awards will need to be messaged in a positive light and clearly explained to employees as to how the change will impact them.

To speak with a member of our compensation consulting group about equity design practices, please write to consulting@radford.com. To learn more about participating in a Radford survey, please contact our team.

Related Articles