With limited pay disclosures and conservative pay practices relative to the US, European life sciences companies should keep the following tips in mind when developing peer groups.

European life sciences companies face a number of challenges in the current corporate governance environment: increased investor scrutiny, new regulatory requirements— including the impending Shareholder Rights Directive— and rising competition both within the region and from the United States (US).

Underpinning many of these changes is the need to create a reliable executive compensation peer group that can provide the baseline for the compensation committee to understand and track relevant market practices. In this fast-moving environment, getting the right peer group is, arguably, as important as ever.

Developing effective per groups for life sciences companies in Europe requires a balancing act between not looking too narrowly or broadly at the market. This can be particularly complex for European-headquartered companies trading on a US exchange. Cross-border listed life sciences companies often have one or more US-based executives who may be paid more aggressively in equity compared to their European colleagues. In this case, we typically recommend creating two peer groups, one with European companies and the other with mostly US-based companies. This exercise enables boards to act on data in a way that balances external market practices against internal pay equity concerns.

No matter what situation your company is in, an effective peer group strategy starts with evaluating three critical areas: recruitment strategy, regional pay differences and data disclosure limitations. We explore each area in greater detail below.

Determine Your Talent Pool

One of the most fundamental questions compensation committees should ask when they assess their peer group is: What is our recruitment strategy? Increasingly, companies are recruiting executive and director-level talent across Europe. Growth in the sector has resulted in cross-border expansion and an overall more competitive job market. Additionally, many of our clients have now hired executives or board members from the US. In many cases, these individuals are recruited to help the organisation break into the US market (e.g., hiring a CFO from the US in preparation to list on the Nasdaq stock exchange). Nonetheless, hiring one or two top executives from a different market doesn’t mean that your peer group should consist of many companies in that new market. When you have executives from two regions with distinct pay practices, it often makes sense to create two separate peer groups to avoid over- or underpaying in any one market. Creating two separate peer groups also avoids the risk of focusing too much on the new market and potentially missing key trends in the local market.

Compensation committees should also be aware of how executive and board member experience plays a role in determining the appropriate market. The expectations of executives, compensation committee members and the entire board will ultimately steer peer group development. As such, where people have spent their careers (whether exclusively in their local market or internationally), and what compensation programs they’ve come across during that time, will influence their thoughts. Being aware of this potential bias can help prevent over-orienting practices based solely on personal experiences and beliefs rather than objectively looking at the facts.

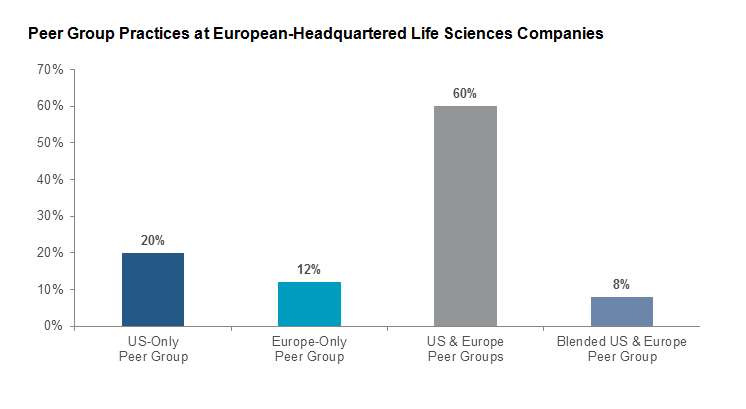

We surveyed 25 European-headquartered life sciences organisations to examine peer group practices among some of our clients. About half of these companies are also listed on a US exchange. The majority of companies have separate European and US peer groups. In these cases, the compensation committee will use information from the two peer groups in multiple ways: sometimes one peer group is for reference only, sometimes the peer groups are used to make distinct compensation decisions in each market, and sometimes one peer group is used as the primary source to target and position pay, while the other is used to make adjustments as needed in unique situations.

Collecting the Right Amount of Pay Data

Our clients often ask us how many companies should be in a peer group. While that’s a valid question, there’s an equally important consideration that influences the size of a peer group— how much compensation data is available for the companies you want to include in your peer group? Even a perfectly-matched business competitor should not be included in an executive compensation peer group if there is no executive or director compensation data available for that company.

This is rarely an issue for companies based in the US and the United Kingdom (UK) because compensation disclosure requirements are more thorough. In the US, companies must disclose the annual compensation for their top five highest paid executives for the past three years in tabular form as well as a narrative explaining the company’s performance goals and other compensation analysis. (Emerging growth companies are exempt from this disclosure for up to five years.) The UK’s approach to executive compensation is also detailed, though more focused on regulation and governance, including a general description of a business’ compensation programs.

For much of Europe, executive compensation disclosure is more opaque, with some companies only disclosing executive pay as an aggregate figure and limiting discussion on individual program elements. This is expected to be addressed by the European Shareholder Rights Directive. Access to executive survey data will also help overcome this challenge.

Once you have determined how many companies have the requisite amount of pay data, we recommend narrowing that list to between 18 and 20 companies. While this may seem like a large sample size, you need the peer group to act a sponge, absorbing changes among your peer group from M&A and potential outliers. Even with a larger sample size, the board should conduct an annual review of the peer group to assess changes among competitors— particularly in the high-growth biotech industry where companies are consistently being bought and sold and moving into different stages of drug development. Ideally, you want to be able to tailor your peer group by stage of development, market value, size and/or therapeutic area— while still keeping in mind your recruitment strategy, talent pool and business growth plans.

Consider Regional Compensation Practices

When developing peer groups, it’s also important to take into account how differences in regional pay practices will influence your results. If you include businesses in markets with dramatically different pay practices, you want to ensure those markets are also where you’re competing for talent. We recommend taking a broad look at the market overall in Europe without weighting too heavily on any one country, particularly if you don’t compete in them. Certain regions tend to have a more egalitarian and conservative approach to equity while others may be more selective on job levels and aggressive with equity targets.

Corporate governance guidelines also drive pay differences across countries. For example, the UK and Sweden restrict the board from receiving stock options, whereas in France, warrant programs are standard compensation for board directors.

While including companies from the US and UK markets will help ensure a robust dataset, we caution against overemphasizing one market that is not your company’s headquarters, especially given regional differences in pay practices. Instead, we recommend clients focus on one primary peer group to drive decisions and use a secondary group for reference purposes.

The following table highlights key criteria and questions to consider when building your next peer group.

Peer Group Development Checklist

|

Validity of Direct Industry Peers

|

Does it make sense to compare your executive compensation practices against your direct commercial competitors? Most of the time yes, but not always.

|

|

Weighting of Selection Criteria

|

What are your most important peer group selection criteria? Your therapeutic area, your stage of development, and/or your market capitalisation, etc.?

|

|

Executive & Board Demographics

|

Where are your executives and board members located? In Europe and the US? Where in Europe— one country or many?

|

|

Recruitment Strategy

|

As the market for executive talent gets more competitive, are you willing to hire talent from other countries? What countries are you most likely to look at next?

|

|

Country of Listing

|

If your country of listing is different than your headquarter location, a balanced view of compensation practices across both markets is strongly recommended.

|

|

Compensation Philosophy

|

Is your compensation philosophy deeply rooted in your local culture? If so, would selecting peers in other countries ever have a chance of aligning to your practices?

|

Next Steps: Putting Tips into Practice

The European life sciences sector is dynamic and constantly evolving. Pay practices and disclosure can be radically different within regions, and yet, companies are increasingly recruiting from a wider geographic area. This makes the task of developing an effective, truly representative peer group much more difficult for compensation committees.

Taking a pan-European approach to developing peer groups will allow companies to reach critical mass in terms of size and available pay data. At the same time, you want to avoid being too aggressive in selecting companies outside of the region where you compete for talent or over-orient to regions where you are expanding into but do not yet have a big presence. An annual review of your peer group(s) will allow time to reevaluate the alignment between existing peers and your evolving business strategy.

Meanwhile, with a larger pool of companies and more detailed pay data in the US, the temptation for European life sciences companies to include US-based organisations in their peer groups is understandable. However, using comparator companies from the US is best utilized as a secondary peer source to supplement your primary group.

To speak with a member of our compensation consulting group about peer group benchmarking or other rewards issues, please write to consulting@radford.com.

Related Articles