The highly competitive hiring environment for skilled positions is not exclusive to the San Francisco Bay Area. New-hire pay is increasing rapidly in emerging tech hubs as well.

The growth of emerging technology hubs has not gone unnoticed in recent years— both in the pages of local and national newspapers, and for those living in affected cities. Among the many pros and cons of living in areas with growing technology workforces are rapidly rising home prices, increases in the cost of living, significant urban development projects, and more traffic jams, just to name a few. Cities like Austin, Denver, Portland, New York City, Salt Lake City and Seattle are all garnering considerable attention as rival hubs to the once and perhaps still undisputed mecca of technology, Silicon Valley. The proliferation of technology hubs is driven by many forces, including industry convergence (i.e., general industry companies hiring employees with technology skills, thereby driving up demand for workers with those skills) and technology companies expanding outside traditional boundaries in search of new markets and more affordable talent.

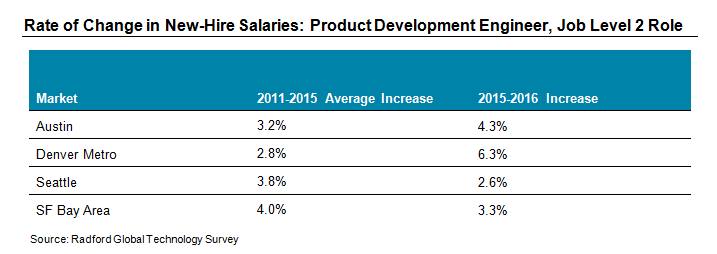

One way to measure the relative competitiveness of the technology sector in hubs is to compare the rate of change in salaries for new hires from one year to the next. To explore this concept further, we took a detailed look at Radford level "P2" incumbents in the product development engineering job family in Austin, Denver and Seattle compared to the San Francisco Bay Area (SFBA). In layman's terms, P2 indicates that these are relatively early career professional individual contributors. We also used highly controlled data sets from the 2011 through 2016 publications of the Radford Global Technology Survey.

As a side note, we limited the scope of this study to developing product development engineering professionals since we know from prior research that technical employees often command a premium over non-technical roles, such as accounting, marketing, HR and sales positions. For more information on this premium, please see our paper As the Race for Top Talent Intensifies, US Tech Firms Ratchet Up New-Hire Equity Awards.

Rate of Change in New-Hire Pay

The first data set we looked at is the rate of change in new-hire salaries each year for developing product development engineers.

The percentage change in new-hire salaries shown in the chart above are the result of product developers being paid higher average salaries each year compared to the people hired during the previous year. The chart is suggesting rapid growth in the Denver and Austin tech markets. This could be the result of a couple different factors. Some companies and individual employees are leaving the SFBA because the cost of living and working in the region is skyrocketing. In order to hire employees from a more expensive market, some companies may be offering higher base salaries than they typically pay local talent for a similar job (of course, the individuals' being hired from the Bay Area may have acquired valued experience working at established tech companies that the companies are also willing to pay a premium to employ). Secondly, there has been an increase in the number of companies opening and expanding business in the secondary markets we analyzed, which drives up competition for a limited pool of job candidates. As we mentioned in the introduction, industry convergence is having an influence on the competitive hiring environment for technology skills as well.

Since the rate of growth in new-hire salaries is faster than the overall rate of increase in salaries, new-hire pay demonstrates the classic example of "compression." Whenever the rate of change in starting salaries increases quickly, we risk not effectively rewarding employees who have gained experience. Unless there is sufficient increase in pay for experienced workers, they may believe their best chance at a raise is to change jobs. While promotions to higher job levels may account for some of the reason why average salaries for those remaining in their roles didn't rise as quickly as the starting rates, this is an important observation to consider when granting pay increases: Are raises keeping employees whole relative to the market movement and recognizing their growing knowledge, experience and contributions?

New-Hire Increases vs. Incumbent Employees

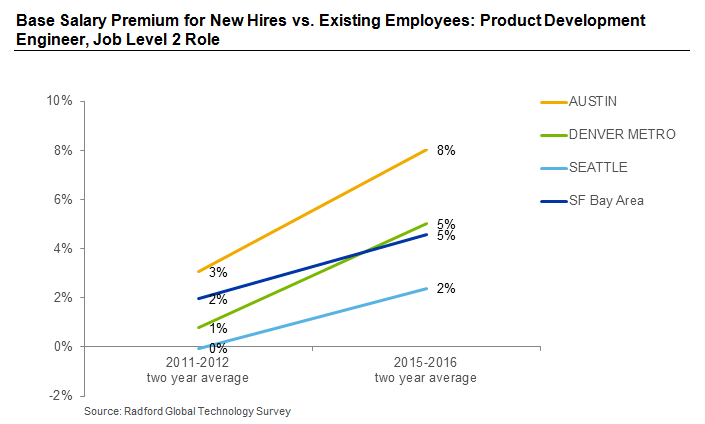

In a second analysis, we examined how the new-hire salary premium changed each year relative to the average salary for existing employees in these same product development engineer roles. Not only did we find a pattern of consistent premium for new hires compared to existing employees' salaries, the differences have increased over time. Of the regions analyzed over the last six years of data, the most dramatic increases appeared in Austin and Denver. The chart below reflects how Denver's new-hire pay premium has eclipsed the SFBA in the past two years.

While the chart isn't showing that the smaller markets pay more than the Bay Area, we do see that the recent hire premium paid to product development engineers hired in Austin and Denver is a higher percentage compared to the Bay Area.

When looking at the past six years in aggregate, we have not seen the secondary technology markets of Austin, Denver and Seattle catch up to pay levels in SFBA. However, in the past couple of years, there is a momentum shift in new-hire salary increases for technical job roles. If this rate of salary growth for new hires in secondary markets continues, we could expect to see a reduced geographic differential in salaries for some jobs between Silicon Valley and other hot tech markets.

Next Steps

Our analysis emphasizes several key points about benchmarking pay for technology jobs in hot markets:

- It's important to look at your internal pay levels compared to new hires to ensure that the referenced pay compression phenomenon hasn't created some internal equity issues for your organization. In an era of greater pay transparency both internally and externally, pay equity is a bigger issue for organizations to address. Much of this discussion has centered on gender and minority pay equality, but any differences in pay for a similar job could raise concerns among employees and can also disrupt a company's salary structures. While the average merit budget is around 3% for most regions in the US, we found the average annual change in recently hired employees' salaries was well above that the average experienced employee's average salary increase in Austin and Denver for the past year.

- There remains a significant difference in the cost of talent in various labor markets. Attracting new talent may require casting a broader geographic net for hard-to-fill positions. If you have to recruit talent from a larger geographic area you may want to look closely at what employees are getting paid using market-specific custom reports to analyze whether salaries candidates are asking for are fair. The regional market for pay may be changing faster than you realize. Radford clients can order custom reports, which segment employees into groups using a "before and after" hire date criterion. For markets with sufficient sample sizes, this can be a meaningful tool for ensuring competitive salary offers.

- We find many of the companies we work with typically create multiple structures for managing pay in different regions across the country. Companies that have not reviewed their geographic differences recently could benefit from a review of pay in markets with significantly sized workforces. Radford survey clients can order a Base Salary Geographic Differential Report for higher level analysis or order custom reports for specific markets.

- Quickly rising starting pay rates may foreshadow some narrowing of regional pay differentials over time in high demand fields. This suggests that a review of total compensation by region and job function is an important analysis to take regularly to ensure the competitiveness of your pay program.

- In the technology market, it's important to look beyond base pay. While our research didn't include equity grants, we would encourage companies that are recruiting in a fast-changing or competitive market to benchmark equity eligibility, goals and target amounts. If you don't want to hire an employee at the top or above your salary range, offering a sign-on bonus, a new-hire equity grant, or participation in the short- or long-term incentive plan (if the position isn't typically eligible) or adjusting target reward levels are all things to consider. Companies that have historically been able to pay more modest equity packages outside of the SFBA may find resistance when trying to bring on new talent at lower equity levels than in Silicon Valley. As employees migrate out of SFBA to new emerging tech hubs, they will come with different perspectives and higher expectations for their pay packages.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles