Voluntary turnover is still on the rise at technology and life sciences companies, and with US firms reporting aggressive hiring plans, keeping sales employees in their seats will be tough.

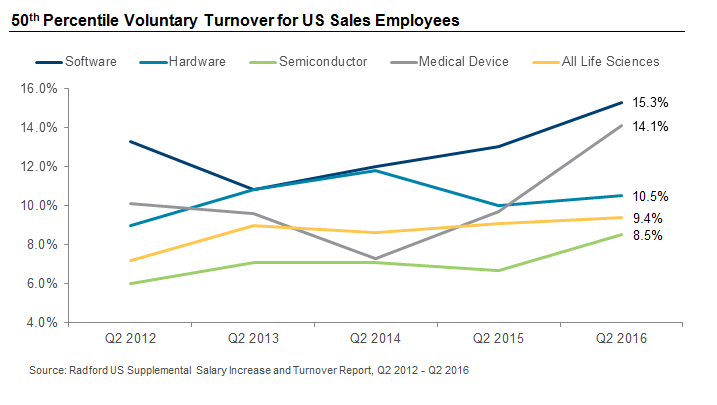

About 18 months ago, we took a five-year look back at voluntary sales employee turnover at technology firms. At the time, median turnover, on a 12-month trailing basis as reported in the fourth quarter of each year, was at a five-year high. Flash forward to today, given continued strength in the overall job market and ongoing growth at US technology and life sciences companies, we decided to revisit our analysis and see if turnover was still trending upward. Using current data from the Radford Global Life Sciences Survey and the Radford Global Technology Survey, we looked at 12-month trailing turnover data reported in the second quarter of each of the past five years. Lo and behold, sales employee turnover is once again at five-year highs across most of the technology and life sciences sectors. The only industry where turnover fell, and just slightly, is hardware.

As we noted in our earlier article, with voluntary turnover at five-year highs, sales and human resources leaders should assess whether their current compensation plans remain effective in an increasingly competitive market for talent. Even in “normal” times, sales force turnover tends be higher in every industry relative to the overall employee population, reinforcing the fact that sales employees are more mobile and have more transferable skills between industries. What's more, we find that once a company's pipeline for new products dries up, becomes stale, or faces increased competition, sales professionals can grow frustrated in their jobs. Clearly, companies must work harder and harder to retain sales reps if they want to avoid the high cost of replacing them. (See our past article, When is it Time to Get Worried about High Sales Force Turnover?, for more information on the costs of turnover in excess of 10%.)

Turnover rates are highest in the fast-growing software industry, where SaaS and cloud-based companies are driving up the demand for talent. Plus, established technology players are actively recruiting sales employees with cloud experience. Not surprisingly, hardware and semiconductor companies have experienced the lowest levels of turnover in the technology sector. The migration to mobile devices has dampened demand for traditional hardware devices, having a direct impact on hardware and semiconductor manufacturers. A PwC report also notes that the Chinese government's pursuit of semiconductor manufacturing has impacted consumer sales at private companies, but the industry is expected to return to more robust growth in 2017.

As we stated 18 months ago, and in light of the new data presented here, we don't expect the pace of sales employee turnover to slow down anytime soon. For the broader technology sector, 15.9% of companies indicate they are hiring aggressively in the US this year. That's the highest among seven countries we analyzed. In the life sciences sector, an impressive 31.9% of US companies have aggressive hiring plans over the next year— far exceeding other large markets.

Next Steps

Companies need to be aware that they are increasingly at risk of losing key sales talent if they do not take proactive measures to keep sales staff engaged. This includes ensuring that complex sales compensation plans are properly designed to motivate employees and reward for high performance. If a company is losing critical sales talent in mass, there are steps it should take to assess the source of the turnover. These steps include:

- Conducting comprehensive exit interviews to uncover aspects of the sales job—including incentive compensation design—that may be causing a disconnect with employees;

- Evaluating the company's hiring practices to see if it is attracting high performers that fit within the company's culture; and

- Investing in quality new-hire training programs and ongoing developmental training.

Once the source(s) of the problem are identified, sales leadership, in partnership with human resources, finance and compensation managers, can work on solutions. However, managers should not be surprised by some level of elevated turnover among their sales staff given the current economic landscape and rates of product innovation.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles