Results from ISS' 2016 Global Policy Survey— the next step in the firm's 2017 policy changes— provide important indicators of potential policy changes to performance metrics, Say-on-Pay voting and more.

Institutional Shareholder Services (ISS) recently released the results of its 2016 Global Policy Survey, which provides insight into the views of institutional investors and companies on a wide range of compensation and governance policy issues (for more details about the survey questions, see our client alert, ISS Releases 2017 Policy Survey, Comments Due by August 30). Later this month, ISS will release draft policies, informed in part by the survey, which will then be subject to a public comment period before they are finalized in mid-November.

Companies should be mindful of the survey results as they influence ISS' policy updates, which will eventually become effective (on a retroactive basis) for all annual meetings after February 1, 2017. In total, ISS received 439 responses to the survey: 29% from investors and 71% from companies. Respondents were predominantly US-based (75%); the rest were from Europe (16%), Canada (7%), Asia (2%) and elsewhere (<1%).

Rethinking TSR: United States, Canada and Europe

ISS asked companies and investors about its approach of using absolute and relative total shareholder return (TSR) over various time periods when evaluating pay-for-performance alignment in its CEO pay screening. Specifically, the firm wanted to know whether survey respondents would want ISS to use other performance metrics, and if so, which ones should be considered. Notably, nearly 80% of investors and 70% of companies supported the use of other metrics. Investors offered the following suggestions for additional metrics (more than one choice was permitted): 47% supported return on investment metrics; 35% favored other return metrics; 26% supported earnings metrics; 25% viewed cash flow metrics positively; and 22% preferred economic profit metrics. Companies generally supported earnings, revenue and return on investment metrics. Additionally, there was mutual support for company- and industry-specific factors.

Many of our technology and life sciences clients may not benefit from the introduction of additional performance metrics into ISS' pay-for-performance analysis, including pre-commercial life sciences companies and early stage tech companies that do not yet have meaningful revenues or earnings.

ISS has given no immediate indication of how it might incorporate other measures. It is possible that instead of incorporating other metrics into its initial quantitative screen for 2017, ISS will instead use other metrics to inform its decisions within a qualitative assessment. The qualitative test is triggered when the quantitative filters indicate a medium or high level of concern. However, with that said, the survey results validate that many institutional investors are recognizing that some compensation for executives may be over-weighted on stock price performance and if alternative performance measures were considered, executives may feel unburdened from the pressure to adopt a relative TSR program in cases where they don't think it's in the best long-term interest of shareholders.

It should be noted that the SEC's proposed pay-vs.-performance disclosure rules from 2015 would measure the performance of a company by the TSR of the company and their peer group over a five-year period. If there is a movement to consider other performance measurements, it remains to be seen whether that would influence the SEC's final rulemaking.

Say-on-Pay Voting Frequency: United States

When mandatory Say-on-Pay voting went into effect in 2011, companies were required to hold a shareholder vote at least every six years with respect to how frequently they would conduct a Say-On-Pay vote (either every one, two or three years). If a company has not done so previously, a frequency vote will be required at 2017 meetings. ISS proxy voting guidelines recommend a vote for annual advisory votes on executive compensation.

ISS is now asking if other factors, such as company size, financial performance, existence of problematic pay practices and prior levels of shareholder support, should be taken into consideration when making a frequency recommendation.

The results show that 66% of investors favor annual Say-On-Pay votes; 17% say frequency should depend on company-specific factors, specifically citing financial performance and problematic pay practices. Only 42% of companies favored annual votes, while 31% believe company-specific factors should be determinative.

Judging by the question, ISS may be open to considering other factors when making a frequency recommendation, but given the majority of their investor clients support annual votes, it seems unlikely ISS will make a formal policy change in this area. Additionally, companies should remember that an annual Say-on-Pay vote can act as a shield to compensation committee members up for re-election, as ISS will generally apply negative compensation related recommendations to compensation committee members when a Say-on-Pay proposal is not on the proxy ballot. Meanwhile, Glass Lewis has given no indication that it will reconsider its de facto annual Say-on-Pay vote recommendation.

Director Tenure and Board Refreshment: United States

The questions of director tenure and board refreshment have received significant attention from the corporate governance community in recent years. This year, ISS sought input on whether "lengthy director tenure" was a genuine concern, and if so, when the appropriate time is to engage with that company. A sizeable number of investors (68%) and a fairly large percentage of business respondents (31%) said a high proportion of long-tenured directors on a board is cause for concern. Just over half of investors and about a quarter of companies responding said the absence of newly-appointed directors was indicative of a problem, and nearly the same percentages said lengthy average tenure was a problem.

While tenure continues to be a high-profile discussion in the media and in boardrooms, it is still typically only problematic with investors when a company has perceived underperformance or on-going corporate governance concerns. That being said, proactive increased disclosure surrounding board tenure and refreshment practices may be a helpful mitigating strategy to avoiding investor concerns in these areas.

Overboarding of Executive Chairs: United States

ISS asked whether its new "overboarding" voting standard for CEOs (restricting them to no more than three total boards, including their own) should be applied to executive chairs. Right now, executive chairs are evaluated by the non-executive director overboarding standard of no more than five total boards. Among investors, 64% support applying the stricter CEO standard, while 36% favored the non-executive director standard. Among companies, it was reversed, with 38% support the stricter CEO standard and 62% favoring the more lenient non-executive director standard. Commenters note that executive chair roles vary from company to company.

Incorporating a stricter standard for executive chairs into a new overboarding policy for 2017 may be a real possibility, as investors often perceive the executive chair and CEO similarly. As such, companies should be prepared for the possibility of an enhanced and more restrictive policy for executive chairs in 2017.

Dual-Class Shares for IPO Companies: United States

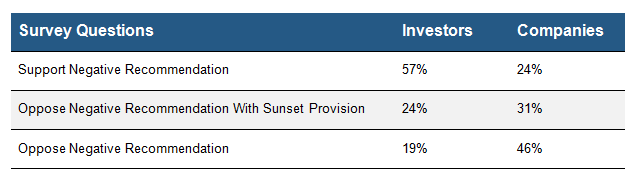

For companies that complete an initial public offering (IPO) or emerge from bankruptcy with a capital structure that includes multiple classes of voting stock with unequal voting rights, ISS is concerned about the potential for abuse and the difficulty in abolishing such a structure. ISS asked whether it should recommend "withhold" votes against directors at such companies. As the chart below shows, investors are much more concerned about dual-class shares at newly public companies than company respondents are.

This question indicates another pre-IPO practice area that may receive additional scrutiny from ISS in the near future. For the past two years, ISS has strengthened its policy against boards making unilateral decisions that strip away shareholder rights when going public (e.g., classifying the board, requiring supermajority voting rights, etc.). ISS recommends against the boards' reelection in these circumstances. Therefore, adding a negative director recommendation policy for IPOs with dual-class shares would seem the next logical step for ISS.

For the first half of 2015— when the IPO market was going gangbusters— about 14% of all IPOs had dual-class shares, according to Dealogic as reported by The Wall Street Journal. That compares to 12% in 2014 and just 1% in 2005. Traditionally a tool of media companies, technology firms have jumped on the bandwagon with Google's landmark IPO in 2004. Technology companies including Facebook, Groupon, Alibaba, Fitbit and Box have all carried the trend forward. Defenders say it allows executives to focus on the long-term vision of the company without worrying about short-term pressures.

Cross-Border Executive Pay Assessments: Cross-Border Listed Companies

Driven by tax inversions and other factors, a growing number of companies are now domiciled in one country, but listed on an exchange in another. Such companies may then be subject to the corporate governance rules in both countries. These differing rules might require multiple compensation-related votes each year. ISS practice has been to review each item according to the policy in the countries where the votes are taking place, which could lead to contradictory outcomes. ISS asked whether vote recommendations should be aligned to avoid such inconsistencies. There was broad support among investors and companies for aligning these voting policies (65% of investors and 59% of companies support a policy change).

Many cross-border listed companies take issue with ISS' current policy of looking purely at the laws and norms of each jurisdiction rather than taking into account where the company's executives are located and where they compete for talent. For example, a company headquartered in London but listed on Nasdaq, and whose executive team is based in New York, may have compensation design and pay levels that are above the norms in the United Kingdom but fall in line with competitive pay practices in the United States. The fact that ISS posed this question indicates that it understands its current framework may yield outcomes that do not adequately factor in business context.

Non-Executive Director Initial Equity Grants: Canada

ISS sought views on the standing practice in Canada to award initial, one-time inducement grants to new non-executive directors. Specifically, ISS wanted to know what acceptable forms of initial equity grants are. Among investors, 33% said time-vested restricted share units, 30% said deferred share units, 21% said stock options, and 21% said inducement grants were unacceptable (multiple answers were permitted). Companies favored all vehicles, including time-vested RSUs, stock options and deferred share units; only 9% said inducement grants were not acceptable.

Similar to certain industries in the US market, on-boarding grants occur rather frequently in Canada. It is important to note that nothing in these results suggests US-based technology and life sciences companies need to make any adjustments to current practices with regard to initial inducement grants to directors.

Pay-for-Performance Quantitative Screens: Europe

Last year, ISS began incorporating US-styled Pay-for-Performance quantitative screens into its compensation policies for Europe as a factor that is considered, but not determinative. ISS is now seeking feedback on how much reliance should be placed on US quantitative screening when evaluating European remuneration voting items at large companies. An overwhelming percent of investors (82%) support the existing "contributing factor" approach, 10% favored it sometimes, and 8% said it should not be used. Over half of companies (57%) support the current approach, 23% favored it sometimes, and 19% said it should not be used.

These results are good news for European companies. The peer groups, pay data, and even scoring results for preliminary European Pay-for-Performance screens can yield inconsistent results and conclusions. Due to variability of the number of public companies in a region, each with their own regional pay schemes, designs, and disclosures, a uniform quantitative model has been difficult to consistently apply across all European countries. As such, we fully expect the qualitative assessments to continue to carry more weight than the quantitative modeling results for the near future.

Next Steps

In the coming weeks and months, as ISS releases its proposed and final policies for 2017, we will publish additional alerts for our client community. In the meantime, if you have executive compensation or governance questions, please write to consulting@radford.com.

Related Articles