Multi-national companies operating in countries with unstable economies need to keep in mind that the principles of market-based pay continue to apply.

Companies managing a global business are exposed to a multitude of strategic and cultural issues— but one of the biggest challenges for human resources professionals is how to respond when a country where they do business and have local employees is hit by sudden and adverse economic events. Should a company intervene with special pay actions or out-of-cycle adjustments? Last year's economic and political turmoil in Russia and consequent devaluation of the ruble is one of many recent examples where HR leaders were faced with that type of question.

While there's no panacea to managing compensation in volatile and uncertain economies, there are systematic questions companies can ask that are more likely to yield rational and consistent policy responses. But first, let's review how pay is managed in a "healthy" or more predictable market. It's important for companies to keep in mind the fundamental principles of setting pay, and that they apply even in volatile markets.

At the most basic level, pay is set by the market supply and demand for labor. Hot skills are a good example of how that works. For example, if there is a surge in demand for certain software or engineering skills and a relatively limited supply, the price of software engineers goes up, as we've recently documented in our article "Technology Firms Aim Higher for Engineers than Executives." Meanwhile, the compensation levels of non-technical jobs have not gone up at the same rate as software engineers — particularly in the San Francisco Bay Area — even though the cost of living is the same for all employees.

There are two common symptoms of unstable economies that can impact employees living and working in such an area: inflation and currency devaluation. Arguably, inflation can have the most adverse effect on the widest range of employees. We'll discuss that first.

Inflation

Inflation is a common result of an unstable economic environment. Argentina, Russia and Venezuela, along with parts of Africa and South Asia, are experiencing inflation above 10%, known as galloping inflation, which can wreak havoc on costs, prices and purchasing power. (It's important to note there are also different definitions of inflation. In the US, "core inflation" omits oil and food prices since they can be inherently unpredictable.) The rate of inflation has a direct correlation with the cost of living. On the surface, inflation or the cost of living might seem tied to the cost of labor. But if we refer back to our Bay Area technology jobs example, that's not the case. Indeed, we find salary increase budgets are not closely related to the cost of living. Instead, salary increases are largely dependent on the supply and demand for certain skills along with individual performance. Under most normal circumstances, pay increases are associated with productivity and growth. Even when prices are rising rapidly, it does not follow what employers can or will provide pay increases to match inflation.

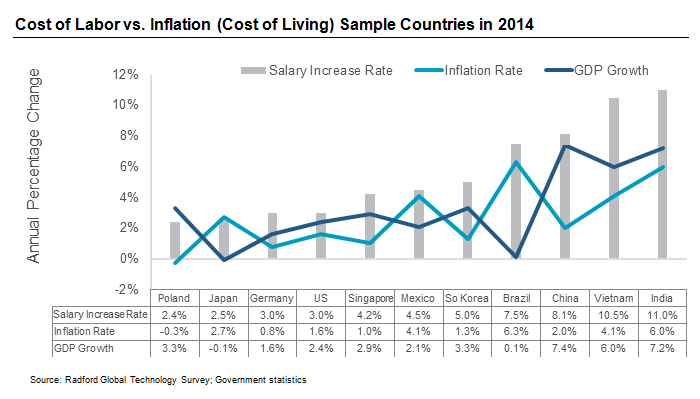

As we can see in the chart below, the cost of labor is usually divorced from the cost of living. In other words, inflation has very little influence over market-based job pricing.

When employers are pressured to provide pay increases to match the inflation rate, they may find that this approach is fraught with unintended consequences. For one, many of the countries that experience high inflation do not have reliable ways of reporting the exact rate of inflation. For instance, Argentina first reported official inflation at 10% to 15%, but it was re-calculated this year and is now reported at 20% to 25%. Private estimates, however, place it at almost 40%. Tying salary increases to the inflation rate can create systemic problems, such as overpaying or underpaying employees in certain regions, pay disparity within the organization, and the need for review and implementation mechanisms to change or reverse salary increases when economies stabilize.

Currency Devaluation

While inflation causes an individual's pay check to be worth less within local borders, sudden or dramatic currency devaluation can be a wholly new symptom of a poorly-functioning economy. It occurs when movements in global currency markets cause a local currency to be worth less compared to “hard currencies” (e.g., US dollars, pounds or euros). This impacts the cost of imported goods, like raw materials and luxury goods. Unlike inflation, the average citizen shouldn't be too impacted if they are buying their goods and services in the local currency, although there may be some price inflation. For ordinary citizens, the devalued currency means higher costs for imported goods and services and international travel. People that send money to relatives overseas or have loans in hard currencies are also negatively impacted.

If a currency becomes severely devalued, companies might feel compelled to begin paying their employees in the particular region in a hard currency vs. their local currency; however, there are several reasons why this is not advisable:

- It can be illegal. Many countries have laws against paying employees in a currency that is not their own. There may be banking restrictions, labor law restrictions and/or currency controls.

- It can complicate paying taxes. Setting up an offshore account in a different currency is frowned upon by most governments because it prevents the employee from being put in the country's social security system and the country may not be able to collect taxes on the money. It could also cause headaches for employees that want to pay federal taxes in order to collect benefits.

- Exchange rates themselves can be erratic. Pegging local pay to an economic indicator like an exchange rate may result in frequent and erratic changes if that indicator is volatile. What's more, pay levels may start to diverge dramatically from actual local market pay.

- Currency crises are part of a larger problem. Challenges in the local economy, such as inflation and shortages in labor or goods, may not be strictly or primarily related to exchange rates. These problems can persist regardless of changes to the currency.

Case Study: Russia

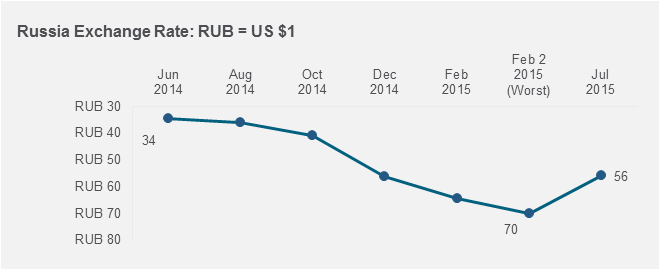

Russian aggression into Crimea and Ukraine prompted the US and other Western countries to impose trade sanctions — severely curtailing Russia's borrowing ability. Meanwhile, a slowdown in global demand for oil (partly due to a rise in shale gas production in the US) caused the price of oil, Russia's main export, to drop to around $50 per barrel. Those factors set off a devaluation of the Russian ruble. Its value plummeted relative to the dollar by about 40% within six months.

So how did companies react to this sudden devaluation of the currency? This was the subject of a custom survey poll we conducted and wrote about earlier this year (see, Managing Compensation Programs in the Face of Russia's Sudden Currency Devaluation). A majority of the multi-national technology companies with employees in Russia that we polled took a "wait-and-see" approach — citing their desire to avoid dramatic, irreversible changes to their compensation packages. A small minority provided some type of temporary allowance or bonus. Even fewer companies said they were considering switching to paying their employees in US dollars as opposed to rubles.

A cautious approach, in this case, seemed to be the right path as the Russian ruble has regained some of its lost value and inflation is starting to turn the corner; oil prices have also rebounded. On the negative side, the Russian economy has fallen into a recession that is projected to continue into 2016.

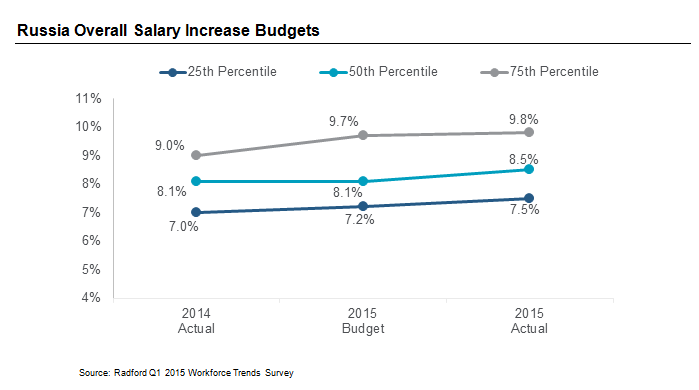

In most circumstances, we advise our clients to take a more conservative approach as the case of Russia illustrates. Using data from the Radford Global Technology Survey, we find most companies in Russia haven't dramatically increased salaries for their technical talent over the past year. Salaries for mid-level engineers are just 6.5% higher than a year ago and overall salary increases for 2015 are running at 8.5% at the 50th percentile. Voluntary employee turnover has declined slightly to a median of 7.7%.

While employees in Russia receive higher salary increases compared to more stable countries like the US, where median salary increases among technology professionals are in the 3.0-3.5% range, companies are budgeting salary increases at a steady rate. From 2014 to 2015 the economic situation in Russia further deteriorated, but salary budget increases only rose slightly. This further reinforces the wait-and-see approach that companies Radford surveyed earlier this year reported.

Next Steps

For companies with a workforce in countries that have high inflation or a sudden devaluation of currency, there are things HR and compensation leaders can be doing — even if they don’t result in taking immediate action. Taking a wait-and-see approach is a reasonable strategy when economic events occur rapidly as they may reverse themselves just as quickly. Compensation professionals should collect information about how economic events are impacting their local employees by identifying actual hardships being encountered, including:

- Are different types of job levels and categories impacted differently by economic conditions? For example, lower-paid employees are disproportionately impacted by a rapid rise in the price of necessities such as food or fuel vs. higher-paid employees.

- Are the hardships situational? For example, do they affect only those employees with loans or payments in hard currencies?

- What are the HR metrics indicating? Are key workforce metrics like employee turnover, hiring ability, and internal equity pay-related? These are indicators of your current labor market.

If an intervention is appropriate, we recommend making it temporary by using the terms “one-time payment” or “lump sum economic adjustment.” Avoid adjustments to salary by formulas tied directly to inflation, currency exchange or other volatile external measures, which will be difficult to unwind once the local economic situation returns back to normal. Consider pay adjustments within the broader context of corporate policies or responses to similar situations in other countries, keeping in mind the impact to the business through employee turnover, hiring ability, and employee engagement. Finally, consider creating separate policies for humanitarian interventions to ensure employees feel cared for in severely unstable conditions that are truly unique.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles