Life sciences companies are benchmarking long-term incentive pay above the 50th percentile compared to other forms of pay — and that's having an impact on actual award value.

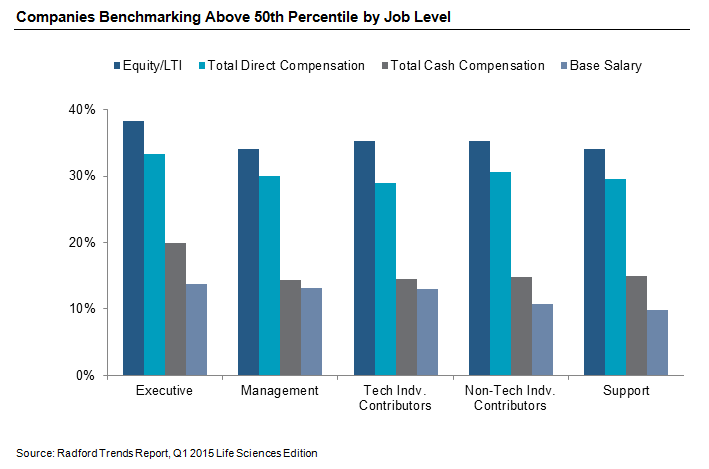

When it comes to equity, life sciences companies are upping the ante for their employees. Overall, they are more likely to benchmark long-term incentive (LTI) pay above the 50th percentile compared to all other forms of compensation. This trend is evident among each job level.

To take a closer look at how companies in the life sciences sector are positioning their different types of compensation, we turn to the Hot Topics section of Radford's Trends Report - Q1 2015 Life Sciences Edition, which addresses competitive pay positioning for base salary, cash compensation, long-term incentive equity, and total direct compensation.

While a majority of companies are targeting pay at the 50th percentile, there is a meaningful number of firms that aim to deliver LTI above the median— and not just for the corner office.

At the executive level, 38.3% of companies benchmark LTI above the 50th percentile; 34.1% do so for management; an equal 35.3% do so for technical professional individual contributors and non-technical professional individual contributors, and 34.1% of companies target LTI above the median for support staff. Those figures are higher than the percent of companies that benchmark above the median for base salary, total cash compensation, or total direct compensation.

Positioning LTI as the most competitive form of compensation doesn't come as a complete surprise. The life sciences sector has a legacy of using equity for a large portion of employee compensation, which enables companies to preserve cash for essential growth opportunities. This is a particularly pressing issue right now for the pharmaceutical industry because it is seeing high levels of M&A activity as companies secure their future pipeline.

In the US, we saw a slight pullback on equity compensation during the 2008-09 Recession and the consequent problem of underwater stock options. However, we've seen a rise in the use of equity incentives in recent years, as well as a continued fondness for stock options in the biotech industry. The Radford Global Life Sciences Survey shows the average percentage of employees at US-based companies receiving an LTI award was 71.0% in the first quarter of the year (based on a 12-month trailing period). That figure is up from 66.7% in 2012.

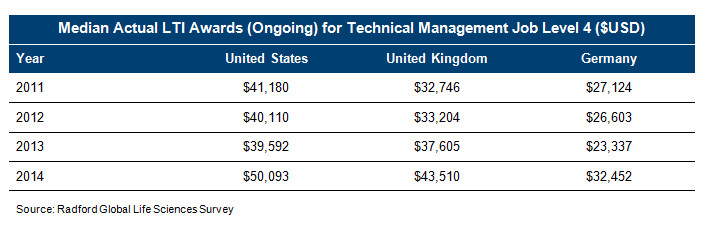

Not only are companies benchmarking above the market median in equity, there has been a rise in actual incentive payouts among all technical management positions at the Director level (Radford job level 4) at most major markets.

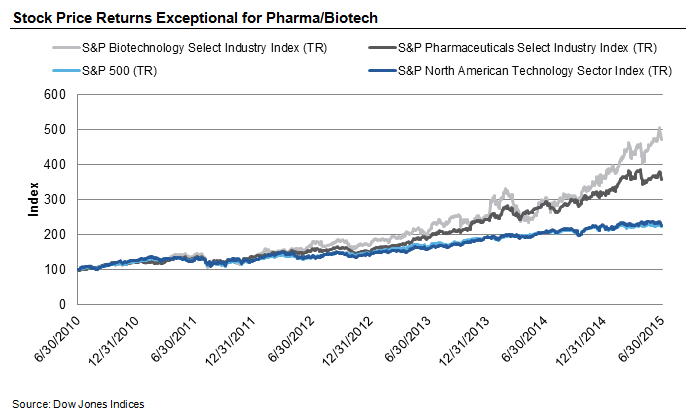

The increased use of equity and the rise in incentive payouts comes amid favorable market conditions in the life sciences sector. Stock performance has outperformed other indices, and the focus on equity pay allows employees to share in the profits while keeping cash compensation costs under control. Over the course of the past five years, biotech and pharmaceutical stocks have risen more than the S&P 500 Index and the S&P North American Technology Sector Index.

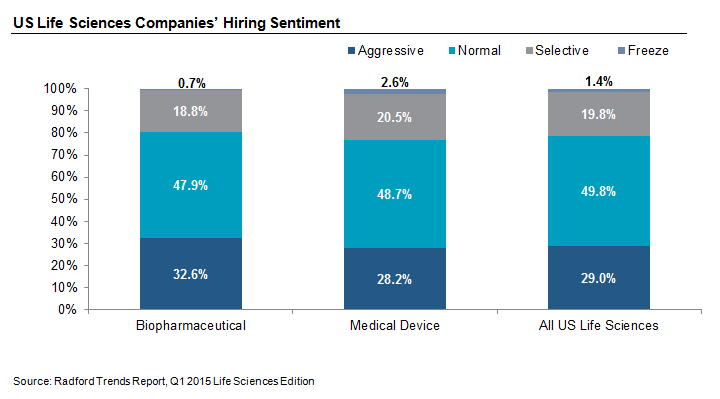

The ability of these industries to produce high returns is fueling future investment, which allows companies to aggressively hire in the market. Their decision to place a premium on equity compensation is strategic. It allows companies to effectively recruit new talent and retain key employees that are attracted by the rising stock gains. However, it also means the opportunity cost for employers continues to escalate as employees amass increasing unvested equity gains.

In the US, 32.6% of biopharma companies say they are aggressively hiring, according to the Radford Trends Report. That's slightly higher than medical devices and all life sciences companies.

Next Steps

The results of our Q1 2015 Trends Report indicate a couple important realities of the current compensation market for the life sciences sector:

- Equity will continue to be an important part of employee compensation packages. It may not be the largest percentage of all employees' total direct compensation, but it is the element of pay that is the most competitively positioned. That fact in itself speaks to the importance of equity awards in attracting and retaining talent.

- Biopharma companies are competing for talent in a limited pool of qualified applicants, which is the driving force behind high levels of benchmarking. What's interesting is that it's not just technical professionals or executives commanding a premium for equity incentives; managers, non-technical professionals and support staff are treated with nearly the same level of competitive benchmarking.

- Companies' decision to place a premium on equity compensation has allowed them to attract and retain talent through rising stock values, but it also means employers will pay an opportunity cost through employees' unvested equity gains.

While stock performance for life sciences companies is generally strong— enabling companies to deliver higher value to their employees through equity awards— this won't always be the case. The dot-com bubble and 2008-09 Recession both serve as important reminders that options can go underwater in a hurry.

If employee compensation programs are designed with above-market competitive equity awards, companies should also have a contingency plan in place for changing market and company conditions. If employers still want to maintain the competitive edge for stock awards, they must be willing to maintain or increase the amount of stock issued if their stock price declines. This could result in shareholder authorization for a new equity pay plan if necessary. Alternatively, if a company's stock price becomes more volatile, compensation professionals may consider transitioning to RSUs and potentially dialing back the competitive positioning of their equity awards for some job levels and offer a more competitive cash component. All of these scenarios are the types of hard questions human resources professionals should be asking even when times are good.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles