If implemented, ISS’s new limits will have a big impact on CEOs who sit on more than one outside board, and professional directors who serve on four or five boards.

Does your CEO serve on more than one public company board other than his or her own? Or do any of your board members sit on more than four public boards in aggregate? If so, look out: Institutional Shareholder Services (ISS) may soon be singling out such directors as "overboarded" and recommending investors vote against their re-election.

ISS' current voting policy allows for CEOs to sit on the boards of up to two additional public companies and non-executive directors to serve on up to six public boards.

ISS says it is still deciding whether to set its voting policy for non-CEO directors at four or five total public boards. The proposed changes would have their biggest impact on CEOs. ISS says the number of CEOs it considers overboarded would jump from 79 (as of June 30, 2015) to 336. For non-CEO directors, the number would increase from 21 to 231 exceeding a four-board limit and 61 directors exceeding a five-board limit. (However, the proxy advisor notes that the actual number of CEOs considered overboarded would decrease somewhat after backing out subsidiary boards, which ISS does not count toward CEO totals).

In its proposed policy change, ISS cites a survey by the National Association of Corporate Directors, which found the average annual time commitment for directors serving on public company boards has increased from 190 hours in 2005 to 278 hours in 2014.

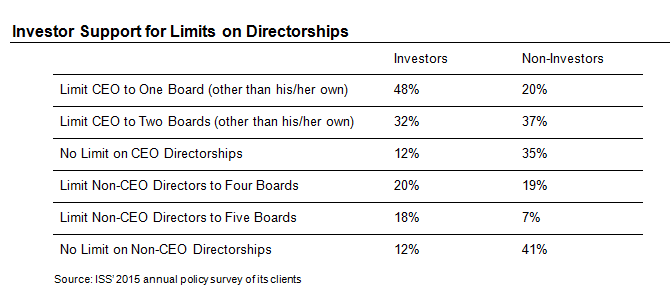

Recent ISS poll results show investor support for the change, but shareholders aren’t in complete agreement about the exact numerical limit to be placed on directorships. Not surprisingly, there is less support from the corporate community that ISS surveyed.

Assuming the firm finalizes the policy change, it wouldn’t go into effect until the 2017 proxy season. However, starting in 2016, ISS will include cautionary language in its research reports identifying all directors who exceed its new limits.

Issuers can submit comments on the proposal until November 9. ISS is expected to finalize all of its policy changes for the 2016 proxy season (including those for Canadian and European companies) by November 18.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles