Introduction

When Zalando SE and Rocket Internet AG began trading on the German Stock Index in 2014, it symbolized that the up-and-coming internet and e-commerce start-up scene around Berlin had arrived. Potential was a now reality. As is the case in Berlin, a new digital economy is quickly taking root in key metropolitan hubs around Europe. The Continent’s “old economy,” long dominated by manufacturing expertise, is increasingly influenced by new innovations across all manner of business processes, including design, production, commerce, delivery, tracking and even maintenance.

The German government deserves a good deal of credit for driving this change. It has encouraged economic transformation through research and development grants, and the Federal Ministry of Education and Research boldly pushes ahead with its “Industry 4.0” agenda. Germany’s next era of industrialization is about information sharing and technologies that enable machines to network with one another to streamline supply chains. It is also about connecting companies more closely to their end-users. Germany is already a leader in the field of Cyber Physical Systems (CPS), which are often used by the automotive industry.

Importantly, the technology wave sweeping through Germany is not just for start-ups. Diverse sectors, from industrial machinery to logistics to hospitality, also rely on internal technical talent to develop the capabilities for innovation. For example, consider that many event centres are investing in mobile technology to notify customers of wait times in concession stands or to offer upgraded empty seats upon arrival, or that a growing number of traditional grocery stores now provide online shopping and delivery.

Missing Talent Drives Global Benchmarking

Despite all of the positive news noted above, Germany's new economy is running up against a critical challenge: a shortage of talent. In Germany, the demand for software and hardware engineers far outpaces the supply of qualified employees. For example, The Association of German Engineers reported 59,260 related job vacancies in the first quarter of 2014, the latest quarter figures are available. Moreover, Germany has the largest share of older-aged engineers compared to other European Union countries. The current gap between talent demand and talent supply could ultimately serve as a brake on economic growth.

To compound issues, the overall hiring environment in Germany is robust, according to our Radford Global Technology Survey Q4 Trends Report. Only 3.7% of technology companies with operations in Germany say they are under a hiring freeze — the second lowest rate among European countries surveyed. At the other end of the spectrum, a full 18.7% of companies say they plan to increase their workforce by 5% or more.

Facing large hiring goals and a dearth of domestic talent, local companies continue to rely on recruiting employees from outside markets. This has a significant impact on staffing costs for German companies, as there are very meaningful differences in pay across international regions. This is especially true when German companies seek experienced talent from developed economies.

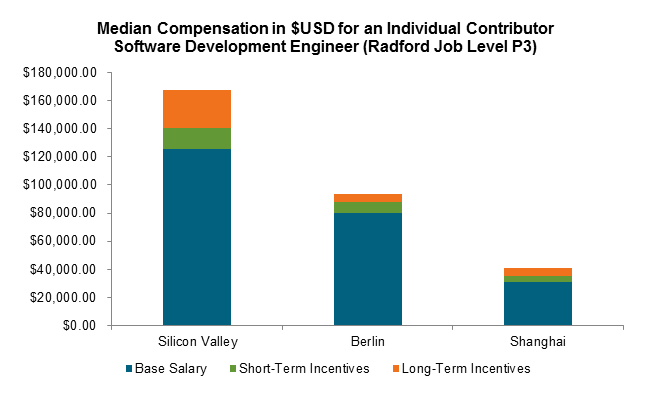

To illustrate this point, the chart below displays what an individual contributor software development engineer is paid in Silicon Valley vs. Berlin and Shanghai according to recent data from the Radford Global Technology Survey. Relative to Berlin, an engineer with similar experience and responsibilities in Silicon Valley commands an 80% premium. Whether German companies decide to recruit talent from Silicon Valley to Germany, or open up a satellite office in the San Francisco Bay Area, it will be costly.

Additionally, our consultants are frequently asked to provide insight into equity compensation practices and overall pay mix strategy for technology sector talent in different regions. As we can see in the chart above, not only does overall pay for software engineers vary by location, but so too does their pay mix. Compensation in the US includes a far greater portion of long-term incentive pay — the majority of which is in the form of restricted stock — while European and Asian labour markets provide mostly cash.

Naturally, recruiting talent from less developed markets like China, India and Eastern Europe can provide significant near-term cost advantages. However, there are hidden costs in these markets, including higher rates of employee turnover, workers with less experience operating at large-scale enterprises, and demand for more rapid increases in pay. Therefore, German companies seeking technology talent need access to a wider and wider array of benchmarking information, including pay levels, pay mix, pay design and workforce trends.

Conclusion

As the German economy continues to transform, local companies will increasingly need to design rewards packages that reflect the highly competitive labour market for employees with specific technology skill sets. This includes non-core technology companies, who find themselves dedicating more and more resources, and jobs, to their technology departments as these areas of the business often represent the largest growth opportunities.

The Radford Global Technology Survey currently allows companies to benchmark 3,000 unique jobs across 1,857 companies with reported survey results in 84 countries. When companies are hiring and retaining employees with in-demand skills, it is essential that they benchmark total pay and pay mix against all regions where they might compete for and recruit talent rather than only looking at the local labour market where they currently operate. Only then can these companies secure real cost advantages and recruit the right talent at the exact moment they need it.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles