Introduction

The popularity of performance-based equity plans with relative total shareholder return ("TSR") metrics continues to rise, meaning it is increasingly likely that regulators, shareholders and proxy advisors will pay closer and closer attention to plan disclosures. While disclosures related to relative TSR plans can include basic overview statements in proxy filings, Form DEF 14A, and the publication of plan document details in periodic filings, Form 8-K, we believe the greatest disclosure risk resides in two key areas:

- Annual financial reporting via Form 10-K, specifically discussions of share-based compensation arrangements under ASC Topic 718; and

- Timely and accurate reporting of Section 16 officer transactions in Form 4 filings.

Annual Reporting via Form 10-K

The most arduous disclosure requirements related to share-based compensation expense fall under an accounting rule named ASC Topic 718-10-50-1, which states that public companies must discuss the following issues as part of their annual Form 10-K filings:

[Companies] shall disclose information that enables users of the financial statements to understand all of the following:

- The nature and terms of such arrangements that existed during the period and the potential effects of those arrangements on shareholders

- The effect of compensation cost arising from share-based payment arrangements on the income statement

- The method of estimating the fair value of the goods or services received, or the fair value of the equity instruments granted (or offered to grant), during the period[.]

When it comes to bullet point A, disclosing the "nature and terms" of relative TSR plans is fairly straightforward. At a minimum, companies must disclose requisite service periods and other substantive award conditions, including vesting conditions or criteria, the maximum contractual term of the equity instrument (i.e., the performance period for the plan), and the target number of awards granted. Going a bit further, a large number of companies also disclose the number of shares associated with maximum performance levels. Together, this information gives shareholder and regulators a broad overview of share-based payment arrangements.

In addition to the general information described above, companies are also on the hook for providing a clear picture of annual award activity in the current income statement (bullet point B). This includes the number of non-vested equity instruments at the beginning of the year, the number of non-vested equity instruments at the end of the year, and the number of equity instruments that granted, vested, and forfeited during the year. Next, this section should include the weighted-average grant-date fair value of all equity instruments granted during the year. In aggregate, this data helps users understand the compensation cost and equity "burn rate" associated with share-based payment arrangements.

Finally, bullet point C requires companies to disclose the method used to determine the fair value of awards granted during the year. This is the area where we most frequently observe opportunity for improvement, both in terms of communication and specific methodology decisions. Numerous methods exist for determining the fair value of equity awards (e.g., the Black-Scholes formula commonly used for stock options); however, one method in particular is most prevalent for relative TSR awards— a Monte Carlo simulation. This method is preferred because it has the best ability to incorporate a variety of plan features and market conditions.

From the standpoint of selecting assumptions, Monte Carlo simulations and the Black-Scholes formula have a lot in common. In fact, the underlying financial theory for both approaches is identical. The biggest difference between the two models is the use of a Correlation Coefficient in Monte Carlo simulations. When assessing the fair value of equity awards with relative TSR metrics, the following bullets outline key inputs and considerations for Monte Carlo approach, which should in term be reflected in public disclosure documents:

- Expected Term – The expected term is generally the same length as the performance period of a relative TSR award. Additional vesting conditions, such as continued service beyond the performance period, should also be disclosed.

- Expected Volatility – Expected volatility plays a pivotal role in valuing any equity award with a market-based component and there a number of valid means to generate this assumption. Disclosures should summarize the method used to generate an assumption, the specific assumption used, and we recommend adding information on peer group volatilities – either an average or range.

- Risk-Free Rate – Companies are required to disclose the risk-free rate they apply toward the valuation of a performance award. The risk-free rate is normally equal to the yield of a zero-coupon US treasury bond with a term commensurate with the remaining performance period.

- Expected Dividends – Dividends paid during the performance period factor into the fair value of an award in two ways, and both are required disclosures. The first impact is in the calculation of TSR itself, which would have dividends reinvested, accrued, or in rare cases, ignored. The second impact on fair value is in the form of dividend equivalents, which are typically paid on actual shares earned. Companies should disclose their expected dividend yield as well as their treatment of dividend equivalents.

- Correlation Coefficient – The correlation of stock prices between a company and each of its peers is an important assumption in the development of fair values for relative TSR awards. Although companies are not explicitly required to disclosure correlation information, we believe it is a best practice worthy of careful consideration. (For additional information, see our article Valuation 101.)

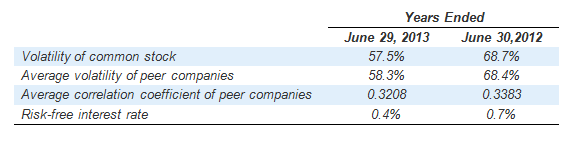

Some companies already choose to disclose correlation coefficients in the 10-K filings, including Bryn Mawr Trust Company, which has an index outperformance relative TSR plan. Companies with percentile rank plans can also disclose coefficient data by providing the average or median pairwise correlations between members of the peer group. The excerpt below from JDS Uniphase Corporation serves as a good disclosure example to follow:

The Company estimates the fair value of the MSUs on the date of grant using a Monte Carlo simulation with the following assumptions:

We believe all companies with relative TSR plans should disclose correlation information, as it increases the transparency of valuation assumptions significantly with virtually no extra effort on the part of the company.

Section 16 Officer Reporting via Form 4

Under Section 16 of the Securities Exchange Act of 1934, "insiders" must file statements of security ownership with the SEC via Form 3, Form 4 and Form 5 filings. Form 4 filings serve as intermediate updates as security ownership changes between starting and ending tenure as a Section 16 officer, and typically must arrive at the SEC within two (2) business days of an ownership event.

When a company grants an award with vesting tied to relative TSR results, there is no obligation to file a Form 4 on behalf of the award recipient at the time of grant. This is the case because performance awards with relative TSR metrics are not treated as derivative securities. Why? Because the amount ultimately paid to the award recipient is based in large part on the performance of other companies. Or in other words, these awards lack a specific stock price target.

As a result, Form 4 disclosure of equity awards with relative TSR metrics should occur within two (2) days of the end of the performance period, or whenever awards are no longer subject to any performance conditions. As this time, the number of shares actually earned as a result relative TSR achievement should be reported for each Section 16 officer recipient. For example, Radian filed a Form 4, submitted on June 10, 2014 for a relative TSR plan with a performance period ending on June 9, 2014.

Form 4 reporting can be confusing for companies along several fronts, including the determination of derivative vs. non-derivative securities, managing data to meet quick-turnaround timing requirements and providing sufficient award details in Form 4 footnotes (especially vesting details). We strongly encourage companies to plan ahead to ensure they have the proper resources in place to assess and report final relative TSR award outcomes.

Section 16 Officer Reporting via Form 4

The proliferation of performance-based equity awards with relative TSR metrics is happening very quickly, meaning disclosures and regulatory oversight will continue to evolve in the months and years ahead. To stay ahead of the curve, we encourage companies to consider the disclosure of peer volatilities and correlation coefficients in annual10-K reports and to invest in accurate and efficient reporting mechanisms to deliver accurate Form-4 disclosures within two (2) business days of relative TSR award payouts.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles