Navigating the Complex World

As the authority on corporate governance, we partner with public and private companies across the globe to navigate complex and routine board, investor and proxy advisory firm issues and policies. Our team has corporate governance experience and consists of former ISS, Glass Lewis and institutional investor proxy voting professionals, as well as numerous legal and regulatory experts.

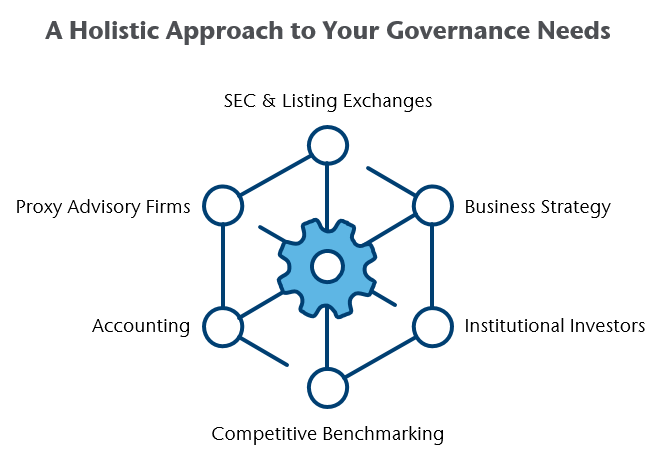

We take a balanced, holistic approach to every key decision, taking into consideration relevant business goals and strategies as well as relevant data points and external standards. Specific to compensation- and talent-related governance needs, Aon’s integrated approach to client solutions allow us to leverage the firm’s knowledge and data from its global Executive Compensation and Talent solutions practices in a seamless manner — making us an efficient one-stop shop for every type of corporate governance need that could arise.